Overview

Who Attends

The LIMRA and LOMA Canada Annual Conference is a key event that draws senior executives and leaders across diverse sectors of the financial services industry and other related business segments seeking to be informed on what’s happening and what’s next, and be engaged in important conversations with their industry peers and other experts.

Highlights

Change happens everywhere, all the time. However, the pandemic has imposed a frenetic and unprecedented pace of innovation, adaptation, and adoption. It has accelerated changes in the economy, business, technology, and more. Capital markets have experienced significant volatility and tightened access to credit. Companies have evolved their tried-and-true operating models and devised new business formulas. The rise of chatbots spawned from artificial intelligence has reduced (or eliminated) repetitive manual tasks and redefined jobs.

Change happens everywhere, all the time. However, the pandemic has imposed a frenetic and unprecedented pace of innovation, adaptation, and adoption. It has accelerated changes in the economy, business, technology, and more. Capital markets have experienced significant volatility and tightened access to credit. Companies have evolved their tried-and-true operating models and devised new business formulas. The rise of chatbots spawned from artificial intelligence has reduced (or eliminated) repetitive manual tasks and redefined jobs.

In their rush to pivot their strategies, businesses sometimes neglect corporate culture. Work-from-home practices have diminished team interactions and are a potential threat to organizations’ ethos. Esteemed management consultant, educator and author Peter Drucker once proclaimed that “culture eats strategy for breakfast.” He was not minimizing the importance of strategy but advocating that a powerful and empowering culture is a more confident and certain approach to corporate prosperity.

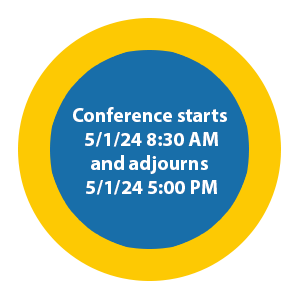

At the 2024 LIMRA and LOMA Canada Annual Conference, industry thought-leaders will address these hot button issues and share their smart strategies for tackling them — all presented from a distinctly Canadian perspective.