LIMRA.com and LOMA.org will be off-line for scheduled maintenance February 21, 2026 from 6 - 10 a.m. ET.

Corrections to Current LOMA Educational Program Texts

Updated July 19, 2024

Corrections that are DATED apply to titles that were printed or downloaded prior to the date of the correction. These corrections have been made to the electronic files (PDFs / e-books / Interactive Study Aids) but may not be reflected in versions that were downloaded and/or printed prior to the correction date. It is the student’s responsibility to check for text corrections prior to taking an examination based on a LOMA text. Corrections to older editions are included in this list for six months following introduction of a new edition.

LOMA 280: Principles of Insurance

Enrollments purchased on or after January 3, 2017 are based on Principles of Insurance, Second Edition (© 2017).

- 2/7/2020 — On page 8.15, in the second paragraph, the sentence

“For the same reason, when a policy is reinstated, a new suicide exclusion period generally begins to run from the date of reinstatement”

should be replaced with:

“When a policy is reinstated, a new suicide exclusion period may begin, or the insurer may continue the suicide exclusion period from the original policy, depending upon the policy wording.”

Test Preparation Guide for LOMA 280 (2017)

- 1/13/2018 — Pages 49 and 51: Some copies of the Test Preparation Guide may show an incorrect answer for Chapter 14, Practice Question # 10. The correct answer should be 2 (not 1). This error appears only in copies of the Test Preparation Guide that were downloaded and printed prior to 1/13/18, and those that were professionally printed and sold to select customer groups.

LOMA 290: Insurance Company Operations

Enrollments purchased on or after October 1, 2018 are based on Insurance Company Operations, Fourth Edition (© 2019).

- 10/11/2019 – On page 2.1, Learning Objective 2D reads, “Explain how insurers use ethics training to address the issues of insider training and compliance with privacy and confidentiality requirements.”

It should read, “Explain how insurers use ethics training to address the issues of insider trading and compliance with privacy and confidentiality requirements.”

- Chapter 7, page 7.1: Industry terminology has changed; in Learning Objective 7D, please substitute the term “statutory accounting principles” for the term “statutory accounting practices.”

- Chapter 7, pages 7.7 and 7.9: Industry terminology has changed. Please substitute the term “statutory accounting principles” wherever the term “statutory accounting practices” appears.

- 1/22/2019 - The FAST Act has amended the Gramm-Leach-Bliley Act. On page 12.23, under Privacy Legislation, please change this sentence:

“The Gramm-Leach-Bliley (GLB) Act is a federal law that requires insurance companies to disclose the insurer’s policies for obtaining and sharing customers’ nonpublic person information at the beginning of the relationship and once a year afterwards…

to

“The Gramm-Leach-Bliley (GLB) Act is a federal law that requires insurance companies to disclose the insurer’s policies for obtaining and sharing customers’ nonpublic person information at the beginning of the relationship. Insurers are also required to provide the notice at least once a year afterwards, unless specific conditions are met…”

- 1/22/2019 - On Glossary.17, please add the bold, italicized phrase to the definition of Gramm-Leach-Bliley (GLB) Act:

A U.S. federal law that requires insurance companies to disclose the insurer’s policies for obtaining and sharing customers’ nonpublic personal information at the beginning of the relationship and at least once a year afterwards, unless specified conditions are met, and to allow customers to opt out of information sharing with unaffiliated third parties. [12]

- 7/12/2022 - Replace the term “Contingent payee” with the term “beneficiary”:

In the last two bulleted items of Figure 13.8 on Page 13.20, please replace the term “contingent payee” with the term “beneficiary.”

In the “Settlement Options” Learning Aid found in Module 5, Chapter 13, please replace the term “contingent payee” with the term “beneficiary.”

Test Preparation Guide for LOMA 290 (2019)

- On p. 33, Learning Objective 7.D. Industry terminology has changed. Please substitute the term “statutory accounting principles” wherever the term “statutory accounting practices” appears (Chapter 7, practice questions #6 and #7 on pp. 33-34, and the Sample Examination question #45 on p. 83).

LOMA 301: Insurance Administration

Enrollments purchased on or after July 1, 2018 are based on Insurance Administration, Fifth Edition (2018)

- 1/22/2019 - On page 2.4-5, under Gramm-Leach-Bliley Act, please change the second sentence to read, “The GLB Act requires insurers to disclose policies for obtaining and sharing customers’ nonpublic personal information at the beginning of a relationship. Insurers must also provide the notice at least annually thereafter, unless specific conditions are met.”

- 2/7/2020 - On page 12.10, in the first bullet, replace these sentences:

“After reinstatement of a lapsed policy, the suicide exclusion period specified in the original policy governs whether benefits are payable. As a result, if a lapsed policy is reinstated before the end of the original suicide exclusion period, the exclusion will continue until the end of the specified period. If the policy is reinstated after the end of the original suicide exclusion period, the reinstated policy typically does not include a suicide exclusion.”

with these sentences:

“After reinstatement of a lapsed policy, the wording of the policy governs whether or not a new suicide exclusion provision begins on the effective date of the reinstatement. The exclusion period may be dated from the original policy issue date or may begin again from the reinstatement date.”

- On page gloss.26 of the glossary, the entry for “right of recommendation” has a typo. Please change “ad” to “and.”

- 3/27/2019 - On page Gloss.29, there is an error in the definition of temporary flat extra premium.

The glossary currently reads:

Temporary flat extra premium. An flat amount added to the premium for cases in which a personal risk factor is expected to remain constant throughout the

life of the policy. [5]

The glossary should read:

Temporary flat extra premium. An amount added to the premium for a risk factor for which the extra mortality risk is expected to decrease and eventually disappear over a limited period of time. [5]

Test Preparation Guide for LOMA 301 (2018)

- 2/6/2020 - In the Test Preparation Guide (TPG) please note the following modifications to question 3 of the chapter 12 practice questions. The revised introduction to the question should read as follows:

Gael Acoca, a resident of the United States, was the policyowner-insured of a life insurance policy issued by the Pageant Insurance Company. Mr. Acoca’s policy included a two-year suicide exclusion period. Three years after the policy was issued, Mr. Acoca died as a result of verified suicide. Upon receipt of a claim for policy proceeds, Pageant most likely would pay...

- 2/6/2020 - In the Test Preparation Guide (TPG) please note the following modifications to question 38 of the sample exam. Replace answer choice (1) with the following:

In the United States, with regard to life insurance claims involving suicide, it is correct to say that, if a proposed insured commits suicide

(1) during the suicide exclusion period and the beneficiary files a lawsuit after the insurer denies the claim, the insurer bears the burden of proving that the insured committed suicide.

LOMA 307: Business and Financial Concepts for Insurance Professionals

Enrollments purchased on or after January 2, 2018 are based on Business and Financial Concepts for Insurance Professionals, Second Edition (© 2018).

- 3/5/2020 - On page 5.16, in the Example box, there is an error in one of the numbers used in the calculation. The text currently reads:

Analysis:

Ardmore’s management fees for these accounts ranged from a minimum of $250 [$50,000 × (0.001 × 50)] to a maximum of $500 [$100,000 × (0.001 × 50)].

The text should read:

Analysis:

Ardmore’s management fees for these accounts ranged from a minimum of $250 [$50,000 × (0.0001 × 50)] to a maximum of $500 [$100,000 × (0.0001 × 50)].

- 2/15/2018 — In Chapter 4, The Time Value of Money, on page 4.19, there is an error in the calculation of the example that shows the calculation for the present values of interest rates that are compounded more frequently than on an annual basis.

The incorrect example reads as follows (incorrect numbers are in bold):

|

For their latest venture, Little needs to know how much money to invest now in order to have $2,000 three years from today. This investment will earn 5% interest, compounded semiannually. The formula for the present value of a single sum is

PV = FV x [1 ÷ (1 + i)n]

Little finds the value for n in this formula by multiplying the number of years—3—by the number of compounding periods per year—2.

n = 3 x 2 = 6

The value for i is found by dividing the interest rate of 5% by the number of compounding periods per year—which is 2 in this case.

i =5% ÷ 2 = 2.5%

Now all Little has to do is plug the numbers into the formula, as follows:

PV = $2,000 x [1 ÷ (1 + .05)6]

= $2,000 x [1÷ (1.05)6]

= $2,000 x (1 ÷ 1.34)

= $2,000 x (.7463)

= $1,492.60

So, Little needs to invest $1,492.60 today, at 5% interest compounded semiannually, in order to have $2,000 in three years.

|

The example should read (corrected numbers are in bold):

|

Now all Little has to do is plug the numbers into the formula, as follows:

PV = $2,000 x [1 ÷ (1 + .025)6]

= $2,000 x [1÷ (1.025)6]

= $2,000 x (1 ÷ 1.16)

= $2,000 x (.8621)

= $1,724.20

So, Little needs to invest $1,724.20 today, at 5% interest compounded semiannually, in order to have $2,000 in three years.

|

- 2/15/2018 - On page 6.17, in the “Beth Morgan” example, the total commissions listed is incorrect. The text states the total as $7,087, and the correct total should be $7,807.

- 2/15/2018 - For the three paragraphs on page 6.18 after Figure 6.5, please note the following information:

On June 22, 2018 the Fifth District Court of Appeals in New Orleans issued a final mandate reversing all DOL rule standards that went into effect June 7, 2017. These paragraphs now provide historical information about the rule.

- 2/15/2018 - On page 8.27, under the heading “Trend Analysis” – Please disregard the following sentence:

Some examples of the trends analyzed are in Figure 8.9.

This text does not include a Figure 8.9.

- 2/15/2018 - On p. 10.9, the text says “U.S. insurers must also file an annual report with the Securities and Exchange Commission (SEC) if the company

• Is a publicly traded stock insurer whose stock is classified as a security

• Offers variable products, such as variable annuities or variable universal life insurance, that are classified as securities”

This information should read:

“The Securities and Exchange Commission (SEC) requires U.S. insurers to publish an annual report for stockholders and other interested parties if the company

• Is a publicly traded stock insurer

• Offers variable products, such as variable annuities or variable universal life insurance, that are classified as securities”

- 2/15/2018 - In the inset example directly following this information, in the Analysis section, all references to “file” should say “publish.”

- 2/15/2018 - On p. 10.10, for the paragraph that begins “Companies that are required to file an annual report with the SEC,” the wording should be “Companies that are required by the SEC to publish an annual report.”

- 2/15/2018 - In Figure 10.3 on p. 10.10, for the last entry in the first column that says, “It must be filed by,” the wording should say, “It must be filed or published by.”

- 2/15/2018 - On p. 10.16 at the bottom of the page, the text states:

The return on invested assets ratio (ROIA) compares a company’s net income to its average invested assets. In equation form,

| ROA = |

Net income

Average invested assets

|

| ROIA = |

Net income

Average invested assets

|

- 2/15/2018 - The glossary definition for conglomerate diversification is incorrect. It currently reads, “conglomerate diversification. A strategy that involves new, related product into a new market. [5]”

The correct definition is Conglomerate diversification. A strategy that involves introducing a new, unrelated product into a new market. [5]

Test Preparation Guide for LOMA 307 (2018)

- 1/22/2019 - Pages 30 and 40: Some copies of the Test Preparation Guide may show an incorrect answer for Chapter 8, Practice Question #12. The correct answer should be 1 (not 2). This error appears only in copies of the Test Preparation Guide that were downloaded and printed prior to x/x/18, and those that were professionally printed and sold to select customer groups.

- 1/22/2019 - Practice question for chapter 10, question 6: The question should be revised to reflect a correction to the textbook (see entry for c. 10, p. 10.9). The corrected question should read as follows:

Under certain circumstances, the Securities and Exchange Commission (SEC) requires a United States insurer to publish an annual report. Of the following circumstances, the one that would result in the insurer’s being required to publish an annual report is if the insurer

For the Interactive Study Aid, the explanations for practice question 6 should read as follows:

Explanation1: Selling term life insurance products would not by itself result in an insurer’s being required by the SEC to publish an annual report.

Explanation2: Selling whole life insurance products would not by itself result in an insurer’s being required by the SEC to publish an annual report.

Explanation3: Selling fixed deferred annuities would not by itself result in an insurer’s being required by the SEC to publish an annual report.

Explanation4: The SEC is a federal government agency that regulates the investment industry in the United States. A U.S. insurer must publish an annual report if (1) the insurer is a publicly traded stock insurer whose stock is classified as a security, or (2) the insurer offers variable products, such as variable annuities or variable universal life insurance, that are classified as securities.

- 1/22/2019 - Sample Exam question #40: The question was changed to reflect a correction to the textbook (see entry for c 10, p. 10.9). The first sentence of the question should read as follows:

“In certain circumstances, the Securities and Exchange Commission (SEC) requires a United States insurer to publish an annual report.”

The last sentence of the question before the answer choices should read as follows:

“Select the answer choice that correctly indicates whether the SEC most likely requires Comet and Neptune to publish an annual report.”

For the Interactive Study Aid, the following corrections apply to the explanations to the answer choices for Sample Exam Question 40:

Explanation1: In the second paragraph, replace the first sentence with the following sentence: “Comet Life does not sell any variable products; however, it must publish an annual report because it is a publicly traded stock insurer.”

Explanations 2, 3, and 4 should read as follows: “For at least one of these companies, this answer choice incorrectly indicates whether the company must publish an annual report.”

LOMA 311: Business Law for Insurance Professionals

Business Law for Insurance Professionals (2020)(e-Book)

Enrollments purchased as of April 2020 or after are based on Business Law for Insurance Professionals, 2020 (© 2020)(e-Book)

- 12/10/2020 – In Chapter 7, Module 3, pg. 7.31 of text PDF. The affected passage is in the Federal Regulation of Insurance Products That Are Securities section, under the Regulatory Oversight of Securities header, the paragraph beginning with “The Securities and Exchange Commission (SEC) is…,” please change the last line of the paragraph and the following paragraph as follows (p. 7.30 – 7.31 of PDF):

The text currently states:

“Sales of stocks that are not traded on a stock exchange are referred to as over-the-counter (OTC) sales. For instance, the sale of a variable annuity is an over-the-counter sale of a security.

As noted above, SEC rules classify variable annuities as securities. However, if an annuity meets the following conditions, it is not a security and is not subject to federal securities regulation:”

The text should state:

“Sales of stocks that are not traded on a stock exchange are referred to as over-the-counter (OTC) sales. For instance, SEC rules classify variable annuities as securities, and so the sale of a variable annuity is an over-the-counter sale of a security.

However, according to SEC rules, an annuity is not a security and is not subject to federal securities regulation if it meets the following conditions:”

- 6/17/2020 – In Chapter 12 of Module 4, under “Trust Agreements,” in the first Let’s Review question, “legal title” should be the correct answer, and the feedback should read, “That’s correct. The trustee has legal title and the trust beneficiary has equitable title.”

LOMA 320: Insurance Marketing

Enrollments purchased on or after April 3, 2017 are based on Insurance Marketing, Second Edition (© 2017).

- 1/22/2019 - On page 1.6, in the second bullet, please change the 2nd sentence to the following:

In addition, the GLB Act requires that a privacy notice be delivered at the time a customer enters into a contractual relationship with a financial services institution. The institution must also provide the notice at least annually thereafter, unless specific conditions are met.

- 1/22/2019 - On page 3.24, please change the first bullet to

Communicate their privacy policies and procedures to all customers when they purchase a contract. Insurers must also provide the notice at least annually thereafter, unless specific conditions are met.

- On Page 9.20 under “DOL Fiduciary Rule,” please note the following information:

On June 22, 2018 the Fifth District Court of Appeals in New Orleans issued a final mandate reversing all DOL rule standards that went into effect June 7, 2017. The paragraph on page 9.20 under the heading, DOL Fiduciary Rule now provides historical information about the rule.

LOMA 335: Operational Excellence in Financial Services

Operational Excellence in Financial Services (2019)(e-Book)

Enrollments purchased on or after June 26, 2019 are based on Operational Excellence in Financial Services (© 2019)(e-Book).

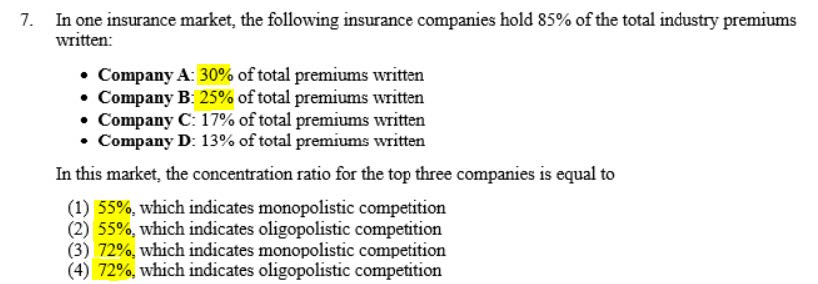

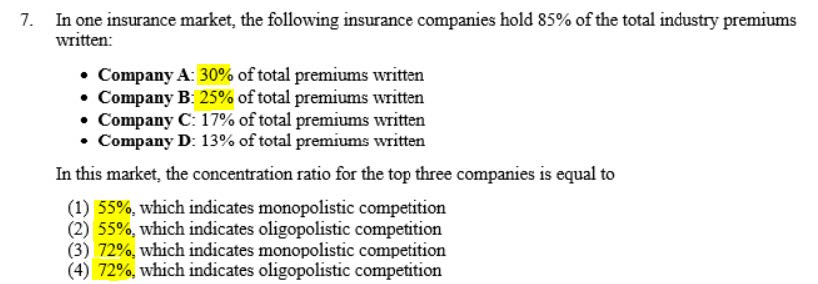

- 8/10/19 – chapter 2 Practice Question #7: Some incorrect numbers were shown in the practice question and in the answer choice explanations. The correct numbers are shown below – corrections are highlighted.

<e4>

- 9/2/2020 – In Chapter 9 of the PDF, on page 9.13, the first paragraph under Prescriptive Analytics gives the definition for predictive analytics.

The paragraph should read:

Prescriptive analytics is a type of proactive data analytics that uses data to suggest decision alternatives and show the possible implications of each decision. Prescriptive analytics relies on information from both descriptive and predictive analytics to recommend actions. An insurer can use the patterns that emerge from the analysis of historical data to predict the future behavior of that data.

LOMA 357: Institutional Investing: Principles and Practices

Institutional Investing: Principles and Practices (2020)(e-Book)

Enrollments purchased after November, 2019 are based on Institutional Investing: Principles and Practices

(© 2020)(e-Book).

- 09/21/2020 – Sample Exam question #16: A student noted that this SE question had two correct responses: (1) and (3). Answer choice (3) was changed to make it incorrect. Answer choice (3) should read as follows: “Bond B has a lower coupon rate than Bond A.”

- 03/04/2022 – In Module 3, Portfolio 1’s Sharpe ratio is 1.13, Portfolio 2’s is 0.98, and Portfolio 3’s is 0.95. They all share the same benchmark, which has a Sharpe ratio of 1.04. Based on this information, which of the following statements is FALSE?

The correct answer is 4, as this is the false statement. Here’s an explanation of each answer choice:

1. This statement is true. A higher positive Sharpe ratio value corresponds to a better risk-adjusted return. With a Sharpe ratio of

1.13, Portfolio 1 DOES have the best (highest) risk-adjusted return of the three portfolios.

2. This statement is true. A higher positive Sharpe ratio value corresponds to a better risk-adjusted return. With a Sharpe ratio of 0.98, Portfolio 2’s risk-adjusted return is higher than Portfolio 3’s (0.95) but lower than the benchmark (1.04).

3. This statement is true. A higher positive Sharpe ratio value corresponds to a better risk-adjusted return; a lower value corresponds to a worse return. With a Sharpe ratio of 0.95, Portfolio 3 DOES have the worst (lowest) risk-adjusted return of the three portfolios.

4. This statement is FALSE. The benchmark does NOT have a better risk-adjusted return than all three portfolios. With a Sharpe ratio of 1.13, Portfolio 1 has a better risk-adjusted return than the benchmark (1.04). Remember that a higher positive Sharpe ratio value corresponds to a better risk-adjusted return.

- 03/10/2023 – Chapter 3, Practice Question #5. In the feedback to answer choice (2), insert ‘investors’ after ‘institutional’ in the second sentence, as follows: Common swaps include credit-default swaps, interest-rate swaps, and currency swaps. Although institutional investors face counterparty risk in all financial contracts, counterparty risk is an especially important concern in swap contracts due to the direct negotiation between the parties. Forward contracts are also negotiated between parties; thus, they expose each party to more counterparty risk than other types of investments.

- 3/10/2023 – Chapter 4, Sample Exam Question. In the feedback to answer choice (3), delete the final ‘s’ from ‘markets’ and add a final ‘s’ to ‘rate’ in the second sentence, as follows:

Statement B is correct. When market rates rise, existing bond market values fall because new bond issues of a similar credit quality will pay investors higher coupon rates than existing bonds. When market rates fall, prices of existing bonds generally rise because new bond issues of a similar credit quality will pay investors lower coupon rates than existing bonds.

LOMA 361: Accounting and Financial Reporting in Life Insurance Companies

Accounting and Financial Reporting in Life Insurance Companies (2019)(e-Book)

Enrollments purchased on or after June 3, 2019 are based on Accounting and Financial Reporting in Life Insurance Companies (© 2019)(e-Book).

- 10/29/2019 – The FASB has changed the effective date(s) for an ASU discussed on page 7.7 of the pdf of this text. The affected sentence is the last sentence in the section called “GAAP Reserves” in Chapter 7 and currently reads,

“According to the FASB, publicly traded life insurers must start following the rules in this ASU for fiscal years beginning after December 31, 2021.”

The text should now read,

“According to the FASB, large publicly traded insurers must start following the rules in this ASU for fiscal years beginning after December 31, 2022. Smaller public insurers must start following these rules for fiscal years beginning after December 2024.”

- 8/2/2019 - c. 3, PQ 4, pp. 40-41

Explanation 4 should be:

The cost concept, also called the historical-cost concept, the cost principle, the initial-recording concept, and the acquisition-cost concept, states that companies should report items on the balance sheet and income statement on the basis of their historical cost, which is their original purchase price on the date of purchase.

- 8/2/2019 - c. 4, PQ 4, pp. 57-58

Second paragraph in explanation 1 should be:

Statement C is correct. Components of OCI generally come from non-core business operations and onetime or unusual transactions. Examples of OCI include unrealized capital gains and losses on certain investments, gains and losses resulting from translating the financial statements of foreign subsidiaries, and actuarial gains and losses related to pensions and other postretirement benefits. If these components were added to net income, the resulting amount could present an inaccurate view of an insurer’s operating performance. To prevent this result, OCI accumulates on the statement of owners’ equity in a section called “accumulated other comprehensive income” or “AOCI.”

- 8/2/2019 - c. 6, PQ 1, pp. 90-91

The last sentence of the stem should be:

Select the answer choice that correctly identifies and provides an example of this asset.

- 8/2/2019 - c. 6, PQ 3, pp. 93-94

Changed depreciated to depreciation in the stem:

At the time of the sale, accumulated depreciation on the Gamut Building was $120,000.

- 10/26/2020 - The FASB has extended the effective date(s) for an ASU discussed on page 7.7 of the pdf of this text. The affected sentence is the last sentence in the section called “GAAP Reserves” in Chapter 7 and currently reads,

“According to the FASB, large publicly traded insurers must start following the rules in this ASU for fiscal years beginning after December 31, 2021. Smaller public insurers must start following these rules for fiscal years beginning after December 2023.”

The text should now read,

“According to the FASB, large publicly traded insurers must start following the rules in this ASU for fiscal years beginning after December 31, 2022. Smaller public insurers must start following these rules for fiscal years beginning after December 2024.”

- 10/11/2019 - Module 2, Chapter 10, Question #10. The correct response should be (1) debit to Salaries Expense in the amount of $600

- 10/11/2019 – Module 2, Chapter 11, Questions #2-4. In the Balance Sheet for this mini-case, the correct total for Other reserves should be $100,000.

- 8/2/2019 - c. 11, PQ 9, pp. 190-191

Changed high to low in Statement A of the stem:

… because a high result is generally more desirable than a low result for this ratio.

- 8/2/2019 - c. 12, PQ 2, pp. 195-196

Revised stem to include overtime pay and replaced explanation 3 (changes highlighted):

To establish and evaluate distinct responsibility centers, a company must be able to separate a responsibility center’s expenses into (1) controllable costs and noncontrollable costs and (2) direct costs and indirect costs. A responsibility manager in an insurer’s underwriting department is considering two costs: the cost of a wellness program that the insurer has made available to all company employees, and the cost of overtime pay within the underwriting department. From the perspective of this responsibility manager, the cost of the wellness program for all company employees most likely would be classified as both a

(1) controllable cost and a direct cost, and the cost of overtime pay within the underwriting department also would be classified as a controllable cost and a direct cost

(2) controllable cost and a direct cost, but the cost of overtime pay within the underwriting department would be classified as a noncontrollable cost and an indirect cost

(3) noncontrollable cost and an indirect cost, but the cost of overtime pay within the underwriting department would be classified as a controllable cost and a direct cost

(4) noncontrollable cost and an indirect cost, and the cost of overtime pay within the underwriting department also would be classified as a noncontrollable cost and an indirect cost

<explanations>

<e1>

It is true that, from the perspective of the underwriting responsibility manager, the cost of overtime pay within the underwriting department most likely would be classified as both a controllable cost and a direct cost. However, the cost of the wellness program that the insurer has made available to all company employees most likely would not be classified as a controllable cost or a direct cost.

<e2>

From the perspective of the underwriting responsibility manager, the cost of the wellness program that the insurer has made available to all company employees most likely would not be classified as a controllable cost or a direct cost. In addition, the cost of overtime pay within the underwriting department most likely would not be classified as a noncontrollable cost and an indirect cost.

<e3>

A controllable cost is a cost over which a responsibility manager has decision-making authority. For example, the costs of supplies, travel, and overtime pay are controllable costs within a department because the responsibility manager can decide whether or not these costs should be incurred.

A direct cost is identified specifically with a single cost object. A cost object is any purpose for which a company measures costs. Sample cost objects include product lines, employee salaries, customer service, and so on. A simple way to determine whether a cost is a direct cost of a specified cost object is to ask: Would the cost disappear if the cost object disappeared? If the answer is yes, then the cost is a direct cost.

Learning Objective: (1) 12A. Define responsibility accounting and identify the features of four types of responsibility centers: cost centers, revenue centers, profit centers, and investment centers; (2) 13A. Identify and distinguish costs that are classified by description, behavior, and measurement.

<e4>

It is true that, from the perspective of the underwriting responsibility manager, the cost of the wellness program that the insurer has made available to all company employees most likely would be classified as a noncontrollable cost and an indirect cost. However, the cost of overtime pay within the underwriting department most likely would not be classified as a noncontrollable cost and an indirect cost.

- 8/2/2019 - c 12, PQ 4, pp. 198-199

Answer choices and answer choice explanations should read as shown below:

Analysts at the Indigo Life Insurance Company reviewed the following budget-to-actual results for the policy issue department:

| |

Budget |

Actual |

| Unit cost of issuing one policy |

$25 |

$22 |

| Number of policies issued |

2300 |

2500 |

This information indicates that the total variance for Indigo’s policy issue department is equal to a

(1) –$1,900 positive unfavorable total variance

(2) $5,000 positive favorable total variance

(3) –$2,500 negative favorable total variance

(4) $5,000 negative unfavorable total variance

<explanations>

<e1>

Indigo’s –$2,500 negative favorable total variance is calculated by adding the negative favorable rate variance of – 7,500 [($22 – $25) × 2,500] to the positive unfavorable usage variance of $5,000 [(2,500 – 2,300) × $25].

<e2>

Indigo’s –$2,500 negative favorable total variance is calculated by adding the negative favorable rate variance of – 7,500 [($22 – $25) × 2,500] to the positive unfavorable usage variance of $5,000 [(2,500 – 2,300) × $25].

<e3>

A product’s rate variance is the difference between the product’s actual rate (or unit cost or unit price) and the standard rate budgeted for that product, multiplied by the actual number of units sold or processed: Rate variance = (Actual rate – Standard rate) × Actual number of units sold or processed. Indigo’s rate variance is calculated as ($22 – $25), multiplied by 2,500 policies issued, which is equal to – $7,500. The rate variance is negative and favorable because Indigo’s actual cost is lower than its budgeted cost.

A product’s usage variance is the difference between the actual quantities sold or processed and the budgeted (standard) quantities to be sold or processed, multiplied by the standard rate or unit cost: Usage variance = (Actual quantities sold or processed – Standard quantities sold or processed) × Standard rate. Indigo’s usage variance is calculated as (2,500 – 2,300) multiplied by $25, which is equal to $5,000. The usage variance is positive and unfavorable because Indigo processed 200 more policies than budgeted.

Total variance = Rate variance + Usage variance. In this situation, Indigo’s –$2,500 negative favorable total variance is calculated by adding the negative favorable rate variance of – $7,500 [($22 – $25) × 2,500] to the positive unfavorable usage variance of $5,000 [(2,500 – 2,300) × $25].

Learning Objective: 12B. Describe how variance analysis is used to measure and evaluate the performance of responsibility centers.

<e4>

Indigo’s –$2,500 negative favorable total variance is calculated by adding the negative favorable rate variance of – 7,500 [($22 – $25) × 2,500] to the positive unfavorable usage variance of $5,000 [(2,500 – 2,300) × $25].

</explanations>

- 10/12/2020 – Practice Question, c. 15, #2: A student noted that the lead-in in the stem of this practice question had an error. The lead-in should read as follows: “In a comparison of top-down budgeting and bottom-up budgeting, it is correct to say that”

LOMA 371: Risk Management and Product Development for Life Insurance Companies

Risk Management and Product Development for Life Insurance Companies

(2021)(e-Book)

Enrollments purchased on or after November 30, 2020 are based on Risk Management and Product Development for Life Insurance Companies (2021)(e-Book).

- 12/29/2023 – Module 1, Chapter 3, Review Question #2, p. 3.25:

In this matching question, option #3 should be ISO 31000 Standard.

- 2/2/2021 – (This does not apply to the digital study materials/Textbook PDF) Module 2, Chapter 5, Practice Question 2, p. 5.38. Explanation 2, first paragraph, first sentence, and Explanation 3, first paragraph, third sentence: replace “fast mover” with “first mover.”

- 12/15/2020 – In Chapter 7, under the heading, “Profit Margin,” two equations are incomplete. The formula in the first blue box should read:

Profit margin = Profits ÷ Sales revenue

The formula in the second blue box should read:

Profit margin = PV of profits ÷ PV of premiums

- 1/20/2021 – In Chapter 7, Time Value of Money. Future Value. Present Value. Let’s Review, Questions 4 and 5, pp. 7.22 and 7.24 (pg. KEY.70 thru KEY.73 of the Answer Key PDF).

- Let’s Review, Question 4. Correct Response (CR) should be flagged as (4) or D. Feedback for all: We determine the FV of this sum as follows: $200,000 × FVIF (2%, 5) = $200,000 × 1.104 = $220,800.

2. Let’s Review, Question 5. Correct Response (CR) should be flagged as (1) or A. Feedback for all: We determine the PV of this sum as follows: $500,000 × PVIF (1%, 5) = $500,000 × 0.951 = $475,500.

- 4/5/2022 - Module 3, Chapter 7, Practice Question #5. There is a typographical error in the feedback for all four answer choices (second paragraph for answer choice 2). The corrected paragraph should read as follows:

When a sum of money is invested for more than one interest period, the interest is compounded: that is, the present value (PV) is multiplied by one plus the interest rate—(1 + i)—one time for each interest period (n) in which interest (i) is applied. In the formula for Mr. Spoth’s calculation, i equals 0.05, and n equals 4. Therefore, he would multiply $10,000 × (1.05)4, which results in a future value of $12,155.06.

- 9/9/2021 - On Page 78 of the Answer Key, for the question that reads:

True/False: The profit margin for a life insurance or annuity product with multiple premiums is calculated by dividing the future value of the product’s profits by the future value of the product’s sales revenue.

The correct answer should be False and the feedback should read: The profit margin for a life insurance or annuity product with multiple premiums is calculated by dividing the present value of the product’s profits by the present value of the product’s sales revenue

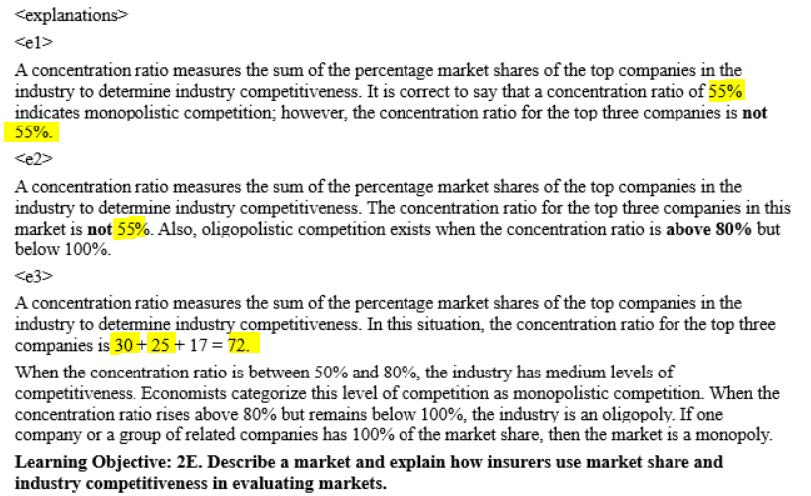

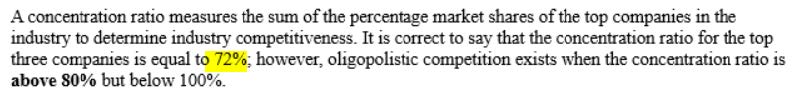

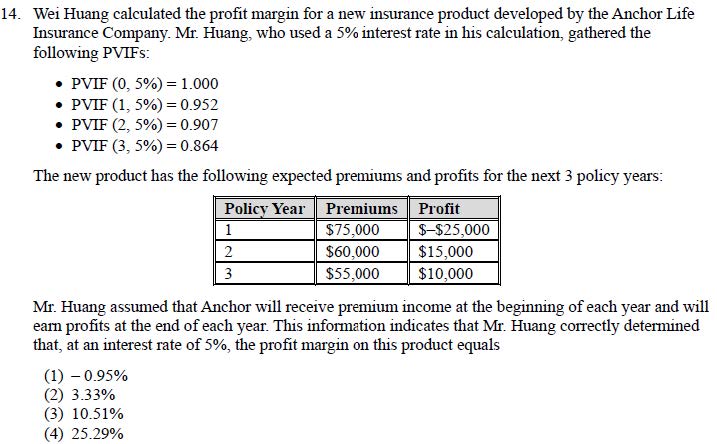

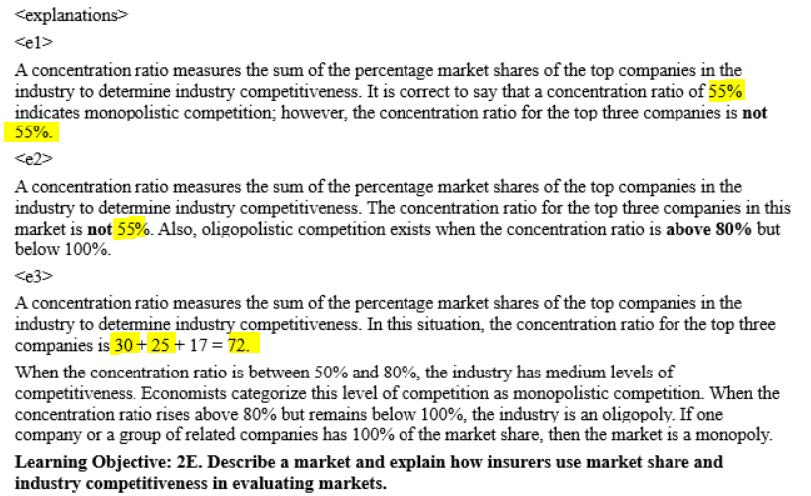

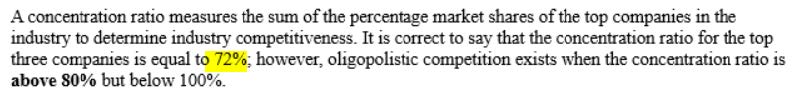

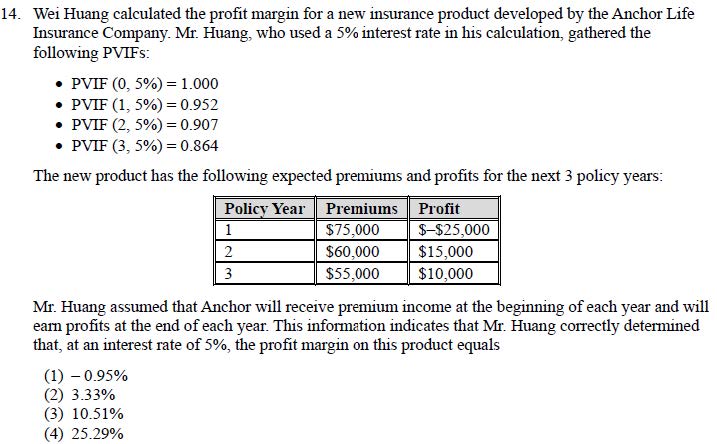

- 1/20/2021 - Chapter 7, Practice Question No. 14. (pg 7.61)

In the chart above, Policy Year 1 Profit should be $25,000, not -$25,000. Answer choices should be

(1) 3.95%

(2) 12.75%

(3) 25.30%

(4) 27.89%.

Correct Response (CR) should be (3).

Explanation: For a multiple-premium life insurance or an annuity product, the product’s profit margin equals the PV of the product’s profits divided by the PV of the product’s premiums. Because Mr. Huang assumes that profits are earned at the end of each year, he calculates the PV of profits using the PVIFs for period n and interest rate i. Therefore, the PV of the product’s profits equals ($25,000 × 0.952) + ($15,000 × 0.907) + ($10,000 × 0.864) = $23,800 + $13,605 + $8,640 = $46,045.

Because Mr. Huang assumes that premiums are received at the beginning of each year, he calculates the PV of premiums using the PVIFs for period (n – 1) and interest rate i. Therefore, the PV of the product’s premiums equals: ($75,000 × 1.000) + ($60,000 × 0.952) + ($55,000 × 0.907) = $75,000 + $57,120 + $49,885 = $182,005. The product’s profit margin equals: $46,045 ÷ $182,005 = 25.30%.

- 11/15/2022 - Correct LOMA 371, Chapter 7, Practice Question #6 Feedback to Correct Response (2) by replacing “ordinary annuity” with “annuity due”: An annuity due is a series of periodic payments for which the payment occurs at the beginning of each specified payment period. Another example of an annuity due is a series of rent payments. When calculating the future value of an annuity due, all payments, including the final payment, earn interest for at least one compounding period.

Other Associate Programs - English

ACS 100: Foundations of Customer Service

Foundations of Customer Service, Third Edition (2015)

- 1/22/2019 - On page 2.17, please change the first bullet under Gramm-Leach-Bliley Act (GLB Act) to

a. Disclose their policies for obtaining and sharing customers’ nonpublic personal information at the beginning of the relationship. Insurers are also required to provide the notice at least annually thereafter, unless specified conditions are met.

Test Preparation Guide for ACS 100 (2015)

- For practice question 6 in chapter 4 (pg. 19), the correct answer is (4) Garden – Parkside – Temple.

ACS 100FR: Fondements du service à la clientèle

Guide de préparation à l’examen ACS 100 (2016)

- 12/1/2018 -- Certaines copies du guide de preparation à l’examen imprimées avant le 1 decembre 2018 peuvent contenir une erreur dans l’examen type.

Il y a une erreur dans la première phrase de l’énoncé de la question numéro 23 contient une erreure: Les mots “efficace” et “efficient” sont inversés. La phrase corrigée est la suivante:

Le processus de service à la clientele à la compagnie financière Festival est efficiente mais pas efficace, selon les definitions de l’efficience et de l’efficacité du consultant en gestion Peter Drucker.

Back

LOMA 280FR: Principes des assurances

Principes des assurances (2011)

- 280, c. 8, p. 118. Il y a une faute de frappe dans le titre suivant:

Passage incorrect: Clauses standard des polices d’asurance

Passage corrigé: Clauses standard des polices d’assurance

LOMA 290FR: Exploitation des compagnies d’assurance, 2nde édition

Exploitation des compagnies d’assurance, 2nde édition (2012)

- c. 13, p. 13, Figure 13.6. Il y a une erreur de traduction dans la description de l’option de période fixe.

Passage incorrect:

Option de période fixe : Lors du décès de l'assuré, Tonya Snellville, bénéficiaire de la police, a choisi de laisser la somme assurée par la police en dépôt auprès de l'assureur et de recevoir un paiement spécifi que de capital et d'intérêts jusqu'à l'épuisement de la somme due.

Passage corrigé:

Option de période fixe : Lors du décès de l'assuré, Tonya Snellville, bénéficiaire de la police, a choisi de laisser la somme assurée par la police en dépôt auprès de l'assureur et de recevoir chaque mois des versements égaux du capital et des intérêts pendant une période de 10 ans.

________________________________________________________

Guide de préparation à l’examen—LOMA 290 (version papier et version interactive en ligne) (2012)

- Questions de révision, c. 3, #11, pg 20. Il y a une erreur de traduction dans la réponse (4).

Passage incorrect:

(4) Les examens ciblés découlent souvent des plaintes de clients ou de changements récents à des réglementations en vigueur.

Passage corrigé:

(4) Les examens ciblés découlent souvent de changements récents à des réglementations en vigueur mais jamais des plaintes de clients.

- Questions de révision, c. 4, #2, pg 21. Il y a une erreur de traduction dans l’énoncé de la question.

Passage incorrect:

Un des résultats provenant de l’utilisation de la dotation en personnel du pays d’origine pour doter un bureau international en personnel est que cela

Passage corrigé:

Un des résultats provenant de l’utilisation de la dotation en personnel du pays d’accueil pour doter un bureau international en personnel est que cela

- Questions de révision, c. 6, #10, pg 33. Il y a une erreur de traduction dans la réponse (1).

Passage incorrect:

(1) Si les actifs d’un assureur augmentent ou si ses passifs diminuent, le capital de l’assureur augmente.

Passage corrigé:

(1) Si les actifs d’un assureur diminuent ou si ses passifs augmentent, le capital de l’assureur augmente.

LOMA 307FR: Concepts commerciaux et financiers pour les prefessionnels de l’assurance

Concepts commerciaux et financiers pour les professionnels de l’assurance (2011)

1. Chap. 7 – pg 159

Il y a une erreur de traduction dans la figure 7.7.

Passage incorrect :

Est généralement la démarche qui prend le moins de temps et qui coûte le moins cher

Passage corrigé :

A tendance à être plus longue et plus coûteuse que d’autres démarches

Guide de préparation à l’examen—LOMA 307

- 1/22/2019 – Practice Question # 6 in Chapter 9 should be replaced with the following:

Bien que les tableaux, diagrammes, graphiques et outils d’ordonnancement permettent aux utilisateurs de visualiser plus facilement des informations, ils peuvent être trompeurs s’ils ne sont pas construits avec attention. L’affirmation/les affirmations ci-dessous à propos de ces présentations visuelles des données est/sont correcte(s) :

(5) A. Les graphiques prêtent à confusion si les quantités utilisées dans l’échelle ne commencent pas par 0.

(6) B. Le fait que différents ensembles de données soient inclus dans le même graphique linéaire prouve qu’ils sont associés et que les changements d’une variable a eu le même effet sur les deux ensembles de données.

(1) A et B

(2) A uniquement

(3) B uniquement

(4) Ni A ni B

- 307 PSE2010-27 (Question ID : 5022), c. 10, pp 213-214. Il y a une erreur de frappe dans l’énoncé de la question.

Passage incorrect :

• L’écart-type des âges de la Population A est de 5

• L’écart-type des âges de la Population A est de 9

Passage corrigé :

• L’écart-type des âges de la Population A est de 5

• L’écart-type des âges de la Population B est de 9

LOMA 320FR: Marketing des assurances

Marketing des assurances (2013)

- c. 3, p. 78. Il y a une faute de frappe à la 4ème ligne du paragraphe “Segmentation par avantages”.

Passage incorrect:

Bien que la plupart des formes de segmentation tentent de monter la relation...

Passage corrigé:

Bien que la plupart des formes de segmentation tentent de montrer la relation...

- c. 3, p. 78. Il y a une faute de frappe à la 4ème ligne du paragraphe “Taux d’utilisation”.

Passage incorrect:

Chaque groupe a des caractéristiques différents…

Passage corrigé:

Chaque groupe a des caractéristiques différentes...

- c. 3, p. 81. Il y a une faute de frappe à la 3ème ligne du paragraphe “ Segmentation géographique pour les marches des entreprises”.

Passage incorrect:

Les mêmes caractéristiques géographiques – telles que l’emplacement, la densité et la croissance de la population, et les exigences réglementaires – utilisées dans le marketing au consommateur influence la manière...

Passage corrigé:

Les mêmes caractéristiques géographiques – telles que l’emplacement, la densité et la croissance de la population, et les exigences réglementaires – utilisées dans le marketing au consommateur influencent la manière...

- c. 3, p. 84. Il y a une faute de frappe à la 2ème ligne du paragraphe “Segmentation comportementale pour les marches des entreprises”.

Passage incorrect: De même que les marchés de consommateurs, les marchés collectifs et des enterprises peut être segmenté…

Passage corrigé: De même que les marchés de consommateurs, les marchés collectifs et des enterprises peuvent être segmentés…

- c. 4, p. 111. Il y a des fautes de frappe à la 1ère et 2ème ligne du paragraphe “Limites de la recherche marketing”.

Passage incorrect: La recherche marketing permet aux compagnies de déterminer quelle est combinaison la plus efficace et efficient des variables du marketing mix.

Passage corrigé: La recherche marketing permet aux compagnies de déterminer quelle est la combinaison la plus efficace et efficiente des variables du marketing mix.

- PPQ2013, question # 44, ref. c. 5, p. 115 – Translation error in explanation of answer # 4 / Erreur de traduction dans l’explication de la réponse no.4.

Passage incorrect :

Un nouvel achat important est une décision d’achat importante, mais le client a déjà une expérience passée du produit ou du service et se sent plus sûr de sa décision. Majestic a pris une décision de

nouvel achat important, car elle avait une certaine expérience dans l’achat de polices d’assurance maladie collective.

Passage corrigé :

Un rachat important est une décision d’achat importante, mais le client a déjà une expérience passée du produit ou du service et se sent plus sûr de sa décision. Majestic a pris une décision de rachat important, car elle avait une certaine expérience dans l’achat de polices d’assurance maladie collective.

- c. 5, p. 122. Il y a une faute de frappe à la 2ème ligne du paragraphe “L’impact des services des achats en tant que groupes principaux de référence”.

Passage incorrect: Les relations entre les membres du services des achats...

Passage corrigé: Les relations entre les membres du service des achats...

- c. 5, p. 122. Il y a une erreur de traduction à la 1ère ligne du 3ème paragraphe du paragraphe “L’impact des services des achats en tant que groupes principaux de référence”.

Passage incorrect: Les membres du service des achats corporatifsanisations moyennes ou grandes…

Passage corrigé: Les membres du service des achats d’organisations moyennes ou grandes…

- c. 5, p. 123. Il y a une erreur de traduction à la 1ère ligne du 3ème paragraphe du paragraphe “Relations entre le conseiller en sécurité financière et la clientèle”.

Passage incorrect: Dans les achats corporatifsanisations, comme dans les achats de consommateurs,...

Passage corrigé: Dans les achats d’organisations, comme dans les achats de consommateurs,…

- c. 5, p. 128. Il y a une de erreur de traduction à la 4ème ligne du paragraphe “Interprétation des informations”.

Passage incorrect: … et ce en fonction de ses propres besoins, valeurs,...

Passage corrigé: … et ce en fonction de leurs propres besoins, valeurs,...

- c. 5, p. 146. Il y a une faute de frappe à la 2ème ligne après la Figure 5.7 dans le paragraphe “Remplacements internes”.

Passage incorrect: …un remplacement est l’action qui consiste à racheter ou a réduire la valeur d’une police d’assurance vie...

Passage corrigé: …un remplacement est l’action qui consiste à racheter ou à réduire la valeur d’une police d’assurance vie...

- c. 5, p. 148. Il y a erreur de traduction à la 1ère ligne de la page.

Passage incorrect: La fidélité de la clientèle dépend en fait de dans quelle mesure une compagnie comprend les besoins de ses clients...

Passage corrigé: La fidélité de la clientèle dépend en fait dans quelle mesure une compagnie comprend les besoins de ses clients...

- c. 6, p. 161. Il y a une erreur de traduction à la dernière ligne du 2ème paragraphe.

Passage incorrect: De nombreux produits ne connaissent jamais de succès et sont retirés du marché sans même se rendre à l’étape d’introduction.

Passage corrigé: De nombreux produits ne connaissent jamais de succès et sont retirés du marché sans même quitter l’étape d’introduction.

- c. 6, p. 163. Il y a une faute de frappe à la 1ère ligne du 2ème paragraphe.

Passage incorrect: L’apparence de matériel écrit et graphique lié au produit,...

Passage corrigé: L’apparence du matériel écrit et graphique lié au produit,...

- PSE2009, question # 29, ref. c.8, pp.205-206 – Translation error in option B / Erreur de traduction dans l’option B.

Passage incorrect :

B. Travaille hors d’une agence

Passage corrigé :

B. Travaille dans une agence

- PPQ2013, item # 86, question # 9, ref. c.8, pp. 219, 220 – Translation error in answer # 1 / Erreur de traduction dans la réponse no. 1.

Passage incorrect :

(1) Un mandataire autorisé est tout représentant autorisé propriétaire, partenaire, conseiller, gestionnaire ou directeur d’un membre de la FINRA qui est activement engagé dans la gestion des activités relevant de la banque d’investissement ou des opérations sur titres du membre.

Passage corrigé :

(1) Un mandataire autorisé est tout représentant autorisé propriétaire, partenaire, conseiller, gestionnaire ou directeur d’un membre de la FINRA qui n’est pas activement engagé dans la gestion des activités relevant de la banque d’investissement ou des opérations sur titres du membre.

- c. 6, p. 179. Il y a une erreur de traduction à la 2ème ligne du paragraphe “Retrait du produit”.

Passage incorrect: Si une compagnie ne parvient pas à modifier de manière efficace et efficiente un produit…, il doit parfois retirer le produit du marché.

Passage corrigé: Si une compagnie ne parvient pas à modifier de manière efficace et efficiente un produit…, elle doit parfois retirer le produit du marché.

- c. 7, p. 195. Il y a une faute de frappe à la 2ème ligne du 3ème paragraphe.

Passage incorrect: La tarification souple pour les produits d’assurance collective prend parfois la forme d’appel d’offres concurrentiels...

Passage corrigé: La tarification souple pour les produits d’assurance collective prend parfois la forme d’appels d’offres concurrentiels...

- c. 7, p. 195. Il y a une erreur de traduction à la 5ème ligne du 3ème paragraphe.

Passage incorrect: Le contrat négocié est un contrat dans lequel les conditions et les prix sont établis à travers des conversations entre l’acheteur et le vendeur.

Passage corrigé: Le contrat négocié est un contrat dans lequel les conditions et les prix sont établis à travers des négociations entre l’acheteur et le vendeur.

- c. 7, p. 195. Il y a une faute de frappe à la dernière ligne de la page.

Passage incorrect: … un taux de prie plus bas par 1 000 $ de protection...

Passage corrigé: … un taux de prime plus bas par 1 000 $ de protection...

- c. 7, p. 196. Il y a une erreurde traduction à la 4ème ligne du 3ème paragraphe.

Passage incorrect: … lorsqu’une compagnie fait payer des taux de prime différents en fonction de la jurisdiction, de la région géographique ou du marché cible dans laquelle un produit est vendu...

Passage corrigé: … lorsqu’une compagnie fait payer des taux de prime différents en fonction de la jurisdiction, de la région géographique ou du marché cible dans lesquels un produit est vendu...

- c. 7, p. 197. Il y a une erreur de traduction à la 5ème ligne du paragraphe “Tarification d’une gamme de produits”.

Passage incorrect: Cela implique la protection des coûts directs de chaque article de la gamme,...

Passage corrigé: Cela implique la couverture des coûts directs de chaque article de la gamme,...

- c. 8, p. 203. Il y a une faute de frappe à la 2ème ligne du 2ème paragraphe du paragraphe “Le contrat d’agence”.

Passage incorrect: Le contrat d’agence entre un conseiller en sécurité financière individual et une compagnie ou une agence d’assurance décrit tous les aspects de l’accort entre les parties.

Passage corrigé: Le contrat d’agence entre un conseiller en sécurité financière individual et une compagnie ou une agence d’assurance décrit tous les aspects de l’accord entre les parties.

- c. 8, p. 207. Il y a une faute de frappe à la 1ère ligne du 2ème paragraphe.

Passage incorrect: A agent de service à domicile,...

Passage corrigé: Agent de service à domicile,...

- c. 8, p. 208. Il y a une erreur de traduction à la 8ème ligne du paragraphe “Représentants de vente salariés”.

Passage incorrect: …, c’est-à-dire des représentants de vente salariés spécifiquement formés dans les techniques de service des produits d’assurance et rentes collectives.

Passage corrigé: …, c’est-à-dire des représentants de vente salariés spécifiquement formés dans les techniques de commercialisation et de service des produits d’assurance et rentes collectives.

- c. 8, p. 210. Il y a une faute de frappe à la 6ème ligne du paragraphe “Octroi de permis de conseiller en sécurité financière”.

Passage incorrect: … et connaissant les produit qu’ils vendent.

Passage corrigé: … et connaissant les produits qu’ils vendent.

- c. 8, p. 210. Il y a une erreur de traduction à l’ avant-dernière ligne du 2ème paragraphe.

Passage incorrect: … et les conseillers en sécurité financière non residents, qui résident dans un autre état ou y conserve son lieu principal d’activités et reçoivent un permis non résident.

Passage corrigé: … et les conseillers en sécurité financière non residents, qui résident ou conservent leur lieu principal d’activités dans un autre état et reçoivent un permis non résident.

- c. 8, p. 211. Il y a une faute de frappe à la 1ère ligne du paragraphe “Rémunération”.

Passage incorrect: La rémunération que les assureurs versent conseillers en sécurité financière et aux directeurs d’agence...

Passage corrigé: La rémunération que les assureurs aux versent conseillers en sécurité financière et aux directeurs d’agence...

- c. 8, p. 211. Il y a une erreur de traduction à la 3ème ligne du paragraphe “Rémunération”.

Passage incorrect: … et une partie intégrale de leur stratégie de marketing.

Passage corrigé: … et une partie intégrante de leur stratégie de marketing...

- c. 8, p. 222. Il y a une erreur de traduction à la 4ème ligne du 1er paragraphe.

Passage incorrect: Les consultants financiers peuvent aussi être appelés “chargés de comptes”,...

Passage corrigé: Les conseillers financiers peuvent aussi être appelés “chargés de comptes”,...

- c. 10, p. 280. Il manque un espace entre deux mots à la 2ème ligne du paragraphe “Réputation du spécialiste des médias”.

Passage incorrect: Les communiqués de presse comprennent le nom d’une personne à contacter,généralement le spécialiste des médias,...

Passage corrigé: Les communiqués de presse comprennent le nom d’une personne à contacter, généralement le spécialiste des médias,...

- c. 11, p. 285. Il y a une erreur de traduction à la 8ème ligne du 2ème paragraphe du paragraphe “Réglementation du marketing des assurances aux États-Unis”.

Passage incorrect: … qui promeut l’uniformité des réglementations d’état en développement des lois et des réglementations types que les états peuvent utiliser comme directives.

Passage corrigé: … qui promeut l’uniformité des réglementations d’état en développant des lois et des réglementations types que les états peuvent utiliser comme directives.

- c. 11, p. 293. Il y a une erreur de traduction dans le titre du paragraphe “Diffusion”.

Passage incorrect: Diffusion

Passage corrigé: Divulgation

- c. 11, p. 293. Il y a une erreur de traduction à la 9ème ligne du paragraphe “Diffusion”.

Passage incorrect: L’Annuity Disclosure Model Regulation (Réglementation modèle pour la diffusion d’informations sur les rentes) de la NAIC...

Passage corrigé: L’Annuity Disclosure Model Regulation (Réglementation modèle pour la divulgation d’informations sur les rentes) de la NAIC...

- c. 11, p. 294. Il y a une erreur de traduction à la 4ème ligne du 1er paragraphe.

Passage incorrect: …, la manière de déterminer la quantité d’assurance vie requise et les autres facteurs dont il faut tenir compte...

Passage corrigé: …, la manière de déterminer le montant d’assurance vie requis et les autres facteurs dont il faut tenir compte...

- c. 11, p. 294. Il y a une faute de frappe à la 6ème ligne du paragraphe “Pratiques commerciales déloyales”.

Passage incorrect: … dans des activités de vente frauduleuses, trompeuses ou contraires à l’étique.

Passage corrigé: … dans des activités de vente frauduleuses, trompeuses ou contraires à l’éthique.

- c. 11, p. 296. Il y a une faute de frappe à la 2ème ligne du paragraphe “Supervision”.

Passage incorrect: La FINRA exige que les maisons de courtage supervisent activement leur personnel de v4ente...

Passage corrigé: La FINRA exige que les maisons de courtage supervisent activement leur personnel de vente...

- c. 11, p. 298. Il faut supprimer une partir du texte en double à la 2ème ligne du 2ème paragraphe du paragraphe “Adéquation”.

Passage incorrect: En 2006, la NAIC a adopté la Suitability in Annuity Transactions Model Regulation (Réglementation modèle d’adéquation dans les transactions de rente) (Réglementation modèle d’adéquation dans les transactions de rente), qui exige...

Passage corrigé: En 2006, la NAIC a adopté la Suitability in Annuity Transactions Model Regulation (Réglementation modèle d’adéquation dans les transactions de rente), qui exige...

- c. 11, p. 301. Il y a une faute de frappe dans le titre du paragraphe “Exigences en matière de confidentialité”.

Passage incorrect: Exigences en matière de confidentialitè

Passage corrigé: Exigences en matière de confidentialité

- c. 11, p. 301. Il y a une faute de frappe à l’avant-dernière ligne du 2ème paragraphe du paragraphe “Exigences en matière de confidentialité”.

Passage incorrect: Dans tous les cas, la personne doit de manière générale avoir la possibilté d’être exemptée, c’est-à dire...

Passage corrigé: Dans tous les cas, la personne doit de manière générale avoir la possibilté d’être exemptée, c’est-à dire...

PFSL 307: Conceptos de Negocios y Finanzas para Profesionales de Seguros

Conceptos Comerciales y Financieros para Profesionales de Seguros (2011)

- En la página 154 del texto, en el encabezado del Informe Anual, el texto actualmente dice:

"En ciertas circunstancias, un asegurador de Estados Unidos debe presentar un informe anual ante la Comisión de la Bolsa de Valores". Esta frase debe decir: "En ciertas circunstancias, la Comisión de la Bolsa de Valores requiere que una aseguradora publique un informe anual". La frase que dice: "Un asegurador de Estados Unidos debe presentar un informe anual ante la SEC, si algo de lo siguiente es verdadero:

• La aseguradora es pública, de acciones que cotiza en la bolsa, en cuyo caso sus acciones son garantía y está sujetas a la regulación de valores.

• La aseguradora ofrece productos variables como anualidades o seguros de vida universales, que son valores sujetos a la regulación de valores"

debe decir: "Un asegurador de Estados Unidos debe publicar un informe anual si el asegurador:

• Es un asegurador de acciones que cotiza en la bolsa

• Si ofrece productos variables, como anualidades o seguros de vida, que son sujetos a la regulación de valores"

En el ejemplo, la frase que dice: "Considere si las siguientes tres aseguradoras, todas con operaciones en Estados Unidos, deben presentar un informe anual ante la SEC:" que debe decir: "Considere si las siguientes tres aseguradoras, todas con operaciones en Estados Unidos, deben publicar un informe anual: "

En este ejemplo, reemplace los términos "archivo" y "enviar" por "publicar".