The Why and How of

Deferred Annuity Buyers

The Why and How of

Deferred Annuity Buyers

November 2022

The annuity industry has undergone major changes over the past several years. The growing popularity of registered index-linked annuities (RILAs), persistently low crediting rates on fixed products, stock market volatility, and continued uncertainty about federal and state-level regulations (e.g., Best Interest) have all had an impact on the ways companies, advisors, and customers interact. At the same time, the pandemic disrupted much of society, including how advisors and clients connect with each other..

With so much change, it is important for annuity carriers and distributors to understand the characteristics and mindsets of today’s deferred annuity buyers in order to improve their products and services. LIMRA recently conducted research that surveys over 900 investors who recently met with their advisor and discussed deferred annuities. This article focuses on the investors who purchased the deferred annuities offered by their advisor within the past three years (“buyers”), and it addresses two key and interrelated questions:

Why did buyers make their purchase decisions?

How do buyers intend to use their annuities?

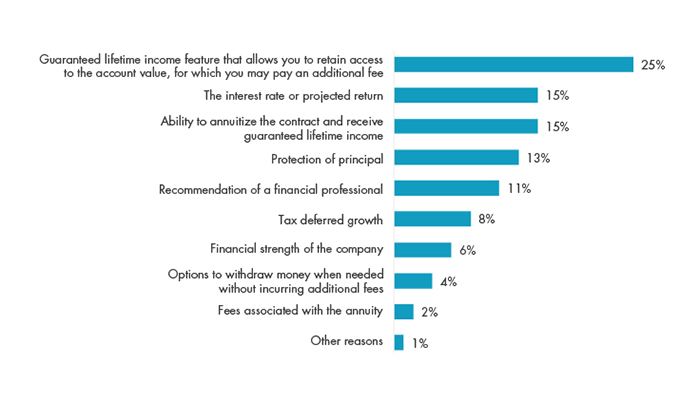

When we asked buyers to indicate the single most important factor involved in their purchase decisions, the top response is guaranteed lifetime income/withdrawal features and the ability to annuitize the contract, followed by the interest rate or projected return (Figure 1). It seems that buyers understand income-generation features as a fundamental, unique aspect of deferred annuities — and simply hearing about these features may have led to the purchase.

Investors with mid-range asset levels are more likely to cite the ability to annuitize as their most important decision factor. Twenty-one percent of buyers with $500,000 to $999,999 in household investable assets cite annuitization as the most important factor, compared with 13 percent of those with assets above or below this range. This stronger perceived value of annuitization for the mass affluent and affluent , among both investors and advisors, has been consistent across LIMRA research studies over the years. However, the vast majority of deferred annuity owners do not end up annuitizing their contracts, preferring instead to activate a GLWB or take systematic withdrawals.

Source: Deferred Annuity Buyers and Non-Buyers, LIMRA, 2022.

The interest rate of return and protection of principal are of major importance for many buyers. This applies especially to older buyers — who likely have more conservative investment allocations and who may be prioritizing legacy goals — and those who bought fixed indexed or fixed-rate deferred products.

Advisor recommendations play the most important role in the decision for 11 percent of buyers. Those with established relationships and regular contact with their advisor are more likely than other buyers are to place advisor recommendations at the top of the list (14 percent versus 8 percent, respectively). Older and retired buyers also are more inclined than younger or non-retired buyers are to rely on advisor recommendations, possibly reflecting their tendency to have established relationships and regular contact with their advisor. In contrast, the ability to withdraw money penalty-free is a key factor for women and those with lower household incomes, perhaps indicating their anticipation of a future need for liquidity.

Buyers rarely mention fees as the most important decision factor. This suggests that, in general, low-fee products do not necessarily have the advantage — and higher-fee products are not at much of a disadvantage — in the purchase process. What triggers the sale is making the connection between the client’s need for sustainable income and the unique features of annuities, as well as other factors like the interest rate, principal protection, and advisor recommendations.

How do buyers plan to use their annuities? What purpose will they serve during their working years and in retirement?

Consumers can use deferred annuities for a number of purposes that fall into four broad categories. They may focus on annuities for income generation, to fund specific expenses, for asset accumulation, or as a wealth-transfer vehicle intending to leave a legacy for heirs or charity.

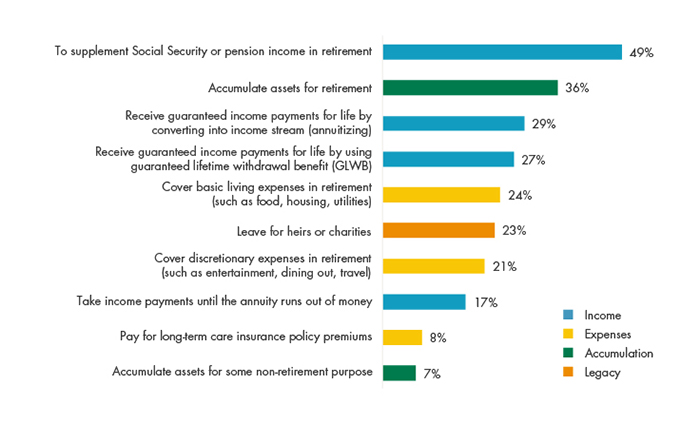

We asked buyers to identify their intended use of annuities, from these categories of income, expenses, accumulation, and legacy. Buyers most frequently cite intentions associated with income (Figure 2). The need to supplement other sources of lifetime-guaranteed income is their top intention (47 percent), while nearly equal proportions mention annuitization and GLWB utilization (29 percent and 27 percent, respectively).

While buyer intentions span all of the potential uses, responses vary based on demographics. Older buyers (as well as those with lower household incomes and higher annuity values) are more likely than other buyers are to intend to use the annuity to supplement Social Security and pensions. Conversely, younger buyers are most likely to plan to annuitize the contract or activate the GLWB in retirement. In addition, younger buyers more often intend to take income payments until the account balance runs out. It may be that older buyers have a better sense of exactly how much lifetime-guaranteed income they will receive in retirement, and they recognize the need to supplement these sources with annuity income.

Note: Based on 595 buyers. Multiple responses allowed.

Source: Deferred Annuity Buyers and Non-Buyers, LIMRA, 2022.

Accumulating assets for retirement is the second most common use mentioned. Younger, non-retired buyers with higher household incomes are the most likely to intend to use annuities for accumulation. On the other hand, older, retired buyers with higher annuity values are the most inclined to use their annuities to leave a legacy to heirs and/or charity.

Buyers cite covering specific expenses least often. The fact that relatively few buyers have specific expense categories in mind may reflect the uncertainty surrounding the exact amount of income their annuities might generate. In addition, non-retirees may not yet know how much their basic living expenses and discretionary expenses might be in retirement.

These findings point to specific opportunities to modify current deferred annuity product marketing, as well as advisor training practices and sales processes:

Income generation is the top decision factor and the top intended use. The ability to activate and receive lifetime guaranteed income is the unique selling point of a deferred annuity. Carriers and advisors should not lose sight of this core value as they position products for wealth accumulation or legacy.

Intended use varies depending on life stage. Carriers and distributions should adopt a segmentation approach to marketing, matching product features with specific financial and retirement goals.

Companies and financial professionals that keep these perspectives top of mind will be most likely to engage consumers in the annuity purchase process and help them obtain the best product and plan for their needs.