Social Media and the

Life Insurance Shopper

Social Media and the

Life Insurance Shopper

November 2022

Online insurance platforms enable today’s consumer to control more aspects of the life insurance shopping process, including finding quotes and payment processing. With no major differences in use by gender, generation, or income, the internet is the most popular shopping resource for buyers of life insurance. As the proliferation and use of social media platforms expand, insurers are establishing channel-friendly marketing campaigns to extend marketing reach.

Online shopping has come a long way since 1994, when the International Shopping Network began sales of computer equipment, including payment processing, online. Promotion of products to people without access to websites happened by mail, telephone, brick-and-mortar sites, and traveling salespeople. As access and consumer trust grew, so too did the practice of entering personal data online. The convenience of shopping on one’s own schedule — perhaps with the benefit of a spouse’s or other family member’s input — helps shoppers become familiar with life insurance terminology, products, and coverage needs.

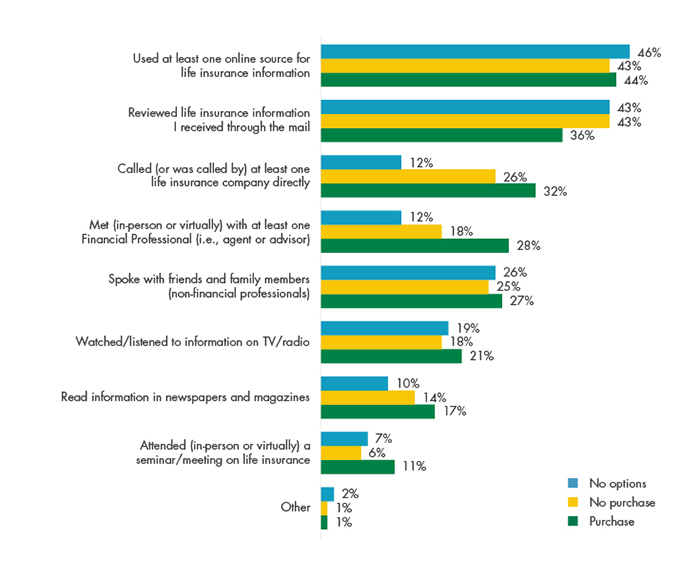

The further consumers move through the “purchase funnel,” the more likely they are to use multiple sources of information. Shoppers who do not apply for quotes (“no options”) use fewer resources than those who apply and do not buy (“no purchase”), and they use far fewer than those who make an individual life insurance purchase. Recent buyers of individual life insurance are more likely to have a telephone conversation with a life insurance company and to meet with a financial professional (Figure 1).

Among recent buyers of life insurance, online shopping increased from 30 percent to 44 percent over 2017 survey results. While the pandemic affected selling and shopping behaviors since 2020, the percentage of consumers preferring to shop, quote, and purchase life insurance online depends on several other factors, including consumer confidence, industry website capabilities, and the proliferation of social media marketing.

Consumers who shop online for financial information use Facebook and YouTube most often. Instagram, LinkedIn, and TikTok are also growing, as life insurance providers move to meet consumers where they are and tailor messaging to fit the audience and their online attention span. To address the limited mindshare or confusion many consumers have when it comes to life insurance, many insurers are investing heavily in a combination of influencers and online advertising to engage them. Various websites appeal to different audiences, and the analytic tools provide real-time reach metrics to guide the industry’s future online marketing investments.

Thirty-seven percent of the world’s population are Facebook users, with 2 billion monthly average users. Over 200 million businesses and 7 million advertisers make the platform an obvious, if crowded, place for life insurers and financial professionals to promote their business. Ease-of-use is a huge factor in the ever-growing popularity of this and other platforms.

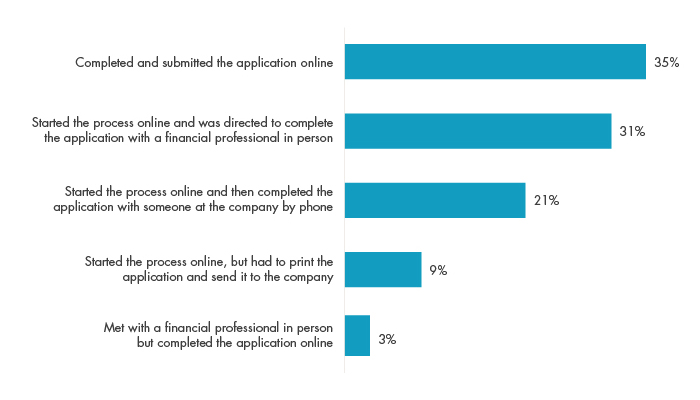

What happens once the insurer has consumer attention is essential to the marketing return on investment. Virtually all recent buyers of individual life insurance start or complete their life insurance applications online (Figure 2). More than half engage financial professionals to complete the application. Some of the interactions with a financial professional to submit an application may be by design, i.e., what an insurer prefers to close sales and advance relationships. While consumers most often cite cost as a reason to not to buy life insurance, only 8 percent of shoppers quoted by a financial professional (versus 44 percent of those who apply online) cite cost as the reason to not buy life insurance.

VisibleThread recently assessed the readability of 20 life insurance company websites, finding many use complex language and lengthy sentences that make it difficult for a typical consumer to understand. While life insurance can be difficult to understand, insurers should seek to recreate the social media experiences millions of consumers know and love — as entertaining (yes) and informative. A dynamic financial professional using a social media platform such as YouTube or LinkedIn, for example, should:

Appeal to consumers’ need for knowledge

Be easy to access for one-to-one follow-up

Reinforce the variety of ways consumers can apply for life insurance quotes

Promote service offerings, from professional advice to online payment processing and ongoing education

Social media is a game changer for stakeholders in our industry, enabling a more transparent understanding of consumer behaviors and greater knowledge of their attitudes related to brand, products, and service. Business development strategies that demonstrate awareness of contemporary adult shopping behaviors — including a variety of cultural norms and views on end-of-life planning — are the most likely to win the attention of consumers. Wherever consumers are in their life insurance ownership journey — shopping, assessing quotes, or purchasing — a relevant social media presence can close the gap with procrastinating or confused consumers.