Workplace Benefits: Weapons in the War for Talent

Workplace Benefits: Weapons in the War for Talent

July 2022

The dramatic changes of the past two years have prompted many employees to reevaluate their goals and priorities when it comes to work, leading to the “Great Resignation” or the “Great Reshuffle.” In March 2022, a record high of 4.5 million Americans voluntarily left their jobs, and the unemployment rate stood at 3.6 percent. LIMRA research reveals that nearly one quarter of employees are actively looking for a new position. Employees currently have the upper hand in employment negotiations as many companies struggle to hire and retain skilled workers. In light of these challenges, employers must reexamine their value propositions to ensure they can compete effectively in the new war for talent.

LIMRA research shows that, despite shifting priorities, employees still place workplace benefits among the top factors they look for in a potential employer. More than half of workers rank medical benefits as one of the top five factors they would seek in a new employer, making these benefits second only to salary in their overall priorities. In addition, nearly one-third of workers rank retirement plans among their top priorities, and over a quarter say other insurance benefits such as life, disability, or dental coverage are top considerations.

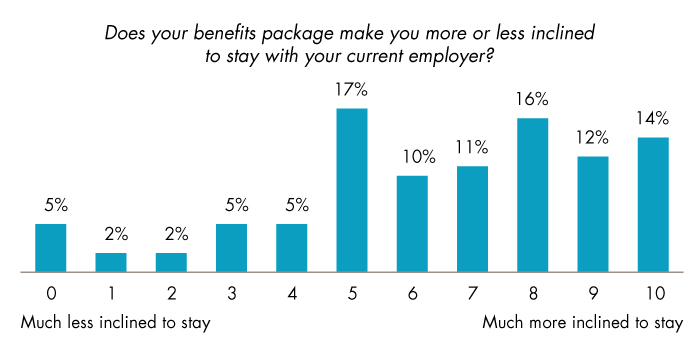

While these findings highlight the important role workplace benefits play in attracting employees, benefits may be even more critical when it comes to employee retention. Employers say that, “creating employee loyalty” is one of the top goals of their benefit programs. Given the cost and time required to fill open positions, it is usually more efficient for employers to prioritize retaining the employees they already have. It is encouraging that 63 percent of workers say their benefit packages make them at least slightly more inclined to stay with their current employers, while 43 percent are considerably more inclined to stay (rated 8 or higher on a 0–10 scale) because of their benefits (Figure 1).

Note: Based on all employees. May not add to 100 percent due to rounding.

Source: BEAT Study: Benefits and Employee Attitude Tracker, LIMRA, 2022.

However, benefit packages that fail to meet employee expectations can have a negative impact on employee retention. One in five workers say their benefit packages make them less interested in staying with their current employers.

The number of insurance benefits offered is an important predictor of whether benefits will have a positive or negative effect on employee loyalty. When companies offer one to three insurance benefits, only 24 percent of employees say their benefits make them considerably more inclined to stay in their current jobs, but this rises to 67 percent when a company offers 10 to 12 insurance benefits. This highlights the fact that additional supplemental or voluntary benefits continue to add value even after “core” offerings such as medical and dental are available. In fact, roughly a third of workers say they are less inclined to stay with their employer who offers only one to three insurance benefits.

As you would expect, employees’ overall satisfaction with benefits also strongly correlates with their likelihood of staying with a company because of those benefits. However, benefit satisfaction must be quite high — rated eight or higher on a 0–10 scale — for it to have a meaningful impact on employee retention. At present, only 46 percent of workers report this high level of benefit satisfaction. To translate benefit offerings into employee loyalty, an employer must go beyond merely offering a “good enough” benefits package, and instead put sincere effort into creating a robust menu of options that truly meets employee wants and needs.

How can employers improve benefits satisfaction? Employees indicate these approaches may help:

Workplace benefits play a significant role in attracting and retaining employees, but many employers are not getting a full return on their investment. By offering a comprehensive suite of benefits that truly meets employee needs — and then successfully communicating those offerings — employers can ensure greater employee satisfaction and increased loyalty.

|

About the Research LIMRA’s BEAT (Benefits and Employee Attitude Tracker) is a new annual survey that monitors employee attitudes toward employment in general and benefits in particular. Over 3,000 U.S. employees were surveyed in late 2021 and early 2022. |