Protection Products Driving the Future of Annuities

July 2022

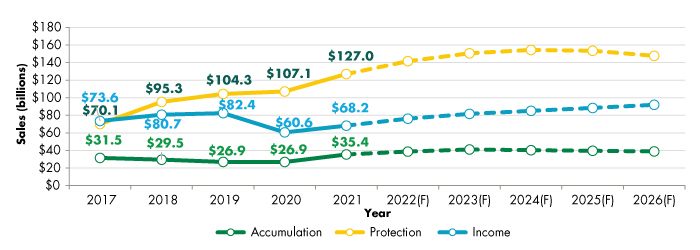

A traditional look at the individual annuity market based on product type — variable, indexed, deferred, etc. — provides companies with essential market detail. However, a more holistic view emerges when we factor in product riders as key features, and assess annuity sales based on the three major investment objectives: accumulation, protection, and income. Ongoing LIMRA research shows a significant shift in individual annuity sales based on investment objective since 2013, and indicates that the trend toward protection-based products will continue through 2025 (Figure 1).

Source: A Future View of Annuity Sales — Redefining the Future, LIMRA, 2022.

Accumulation-focused sales have remained steady until recently, as a result of:

In 2021, fueled by the increased appetite for tax-deferred investment solutions, accumulation-focused annuity solutions experienced 32 percent growth. With the Biden administration continuing to look at tax revenue opportunities, particularly among wealthier Americans, we expect accumulation-focused sales through 2026 to continue above the levels seen prior to 2020, with the potential to expand distribution opportunities in the RIA channel. We expect the appetite for tax deferral to continue, and dependent on any tax law changes in the future this segment could grow even more than expected.

In contrast, protection-based products have risen steadily since 2013, due to:

Protection-based annuity sales continued as a focal point in 2021, with sales increasing by 19 percent as Americans continued to face uncertainty. The value proposition of protection will continue to resonate with Americans seeking to balance growth with downside protection. We anticipate protection-based annuity sales will continue to grow, and exceed $150 billion by 2024.

Products with guaranteed income features made up a majority of sales in 2013, but then steadily declined until recently. This is a result of:

Sales of income features in annuities bottomed out in 2020 as individuals — distracted with the global pandemic — became less focused on long-term retirement planning. In 2021 — despite favorable demographics, more Americans entering retirement, and a sales rebound of 13 percent — income products remained well below pre-pandemic levels. We do expect the demand for guaranteed income to increase, especially considering there will be 8.5 million more Americans aged 65 and older in 2026 than there are today. In addition, fewer individuals will have the backstop of a pension in retirement. However, even with the expected improvement, it will take until 2024 for sales to increase above pre-pandemic levels.