Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

2/1/2022

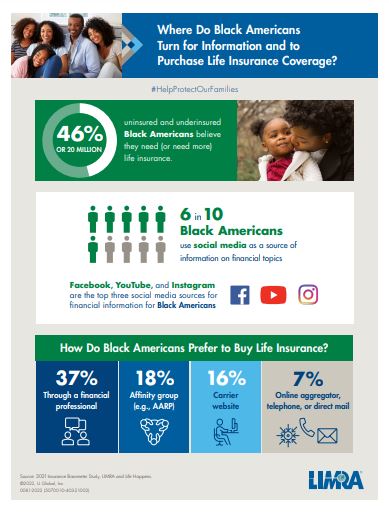

Black Americans recognize the important role life insurance plays in protecting their loved ones. According to the 2021 Insurance Barometer study, conducted by LIMRA and Life Happens, 56% of Black Americans own life insurance, which is higher than the national average (52%). Yet 46% of Black Americans — representing 20 million adults — say they need (or need more) life insurance coverage, which indicates a substantial coverage gap in the Black American community.

In 2021, as COVID-19 continued to spread across the country, Black Americans were disproportionately affected by the pandemic both physically and financially. While Black Americans reported higher levels of financial concerns about paying monthly bills, saving for emergencies or leaving an inheritance, saving for retirement, and reducing student debt, research also showed a higher intent to purchase life insurance coverage. According to the study, 58% of Black Americans said they intend to purchase life insurance within the year, significantly higher than the general population’s purchase intent (36%).

Dispelling Misconceptions

Moving these consumers from intention to action may require helping them understand how affordable and accessible life insurance is. The top reason Black Americans give for not purchasing coverage is that it is too expensive. Yet 75% of Black Americans overestimate the cost of life insurance threefold. In addition, more than half (54%) say they don’t know what to buy or how much they need and over a third (35%) don’t think they would qualify for coverage. Insurers and financial professionals can help overcome these obstacles by providing tools and resources to help Black Americans determine their life insurance needs and assure them they can obtain coverage.

|

|

| Click on the images to view the individual infographics | |

The study also suggests Black Americans might have a limited view on the many ways life insurance can help address their financial concerns. The study finds Black Americans are more likely than other market segments to view life insurance only for burial and final expenses. Thirty-one percent of Black Americans believe that life insurance is only for final expenses and 66% say that is the primary reason they own life insurance. Just 48% of the general population say the same. This perception of life insurance could result in Black Americans not purchasing enough coverage to provide income replacement or enable wealth transfer, two key ways life insurance can benefit loved ones after a wage earner dies.

The Need Remains Great

Despite the fact that Black Americans are more likely to own life insurance than the general population, there remains a considerable number of Black American families at risk. More than half of Black American households (55%) say they would face financial hardship within six months following the death of a wage earner — nearly a third (31%) would struggle financially within a month. As our nation commemorates Black History Month, it is also a good reminder about the industry’s responsibility to engage with the 20 million uninsured or underinsured Black Americans who know they need (or need more) coverage and help them protect their families’ financial futures.

LIMRA is honored to lead the Help Protect Our Families campaign, an industrywide effort to raise awareness about the importance of life insurance and help carriers and distributors address the growing coverage gap in the United States. Visit the Help Protect Our Families website for more resources and data on the Black American market.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184