Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

2/4/2021

By David Levenson

President and Chief Executive Officer, LIMRA, LOMA, and LL Global, Inc.

The changing from one year to the next always marks a new beginning. Moving into 2021 holds significant meaning as we hope to begin to move forward from the unimaginable difficulty the pandemic created in 2020 and look forward to brighter times ahead.

The changing from one year to the next always marks a new beginning. Moving into 2021 holds significant meaning as we hope to begin to move forward from the unimaginable difficulty the pandemic created in 2020 and look forward to brighter times ahead.

As we take a collective breath, we can reflect on one encouraging aspect that may endure from the crisis — the reawakening to the importance of life insurance. LIMRA research shows that 29% of adults are more likely to purchase life insurance over the next 12 months compared to their propensity to buy pre-pandemic. For those who already own life insurance, likelihood to buy rises to 61%. These are families that our industry can and should proactively serve.

The core purpose of our industry is to protect families from the financial hardship that may occur with the premature death of the breadwinner. That is why we exist. And the need has never been more pressing. To date, more than 25 million Americans have been infected with COVID-19 and more than 450,000 have died as a result of it. These families are not only suffering from emotional anguish, but many also are facing a heavy financial cost.

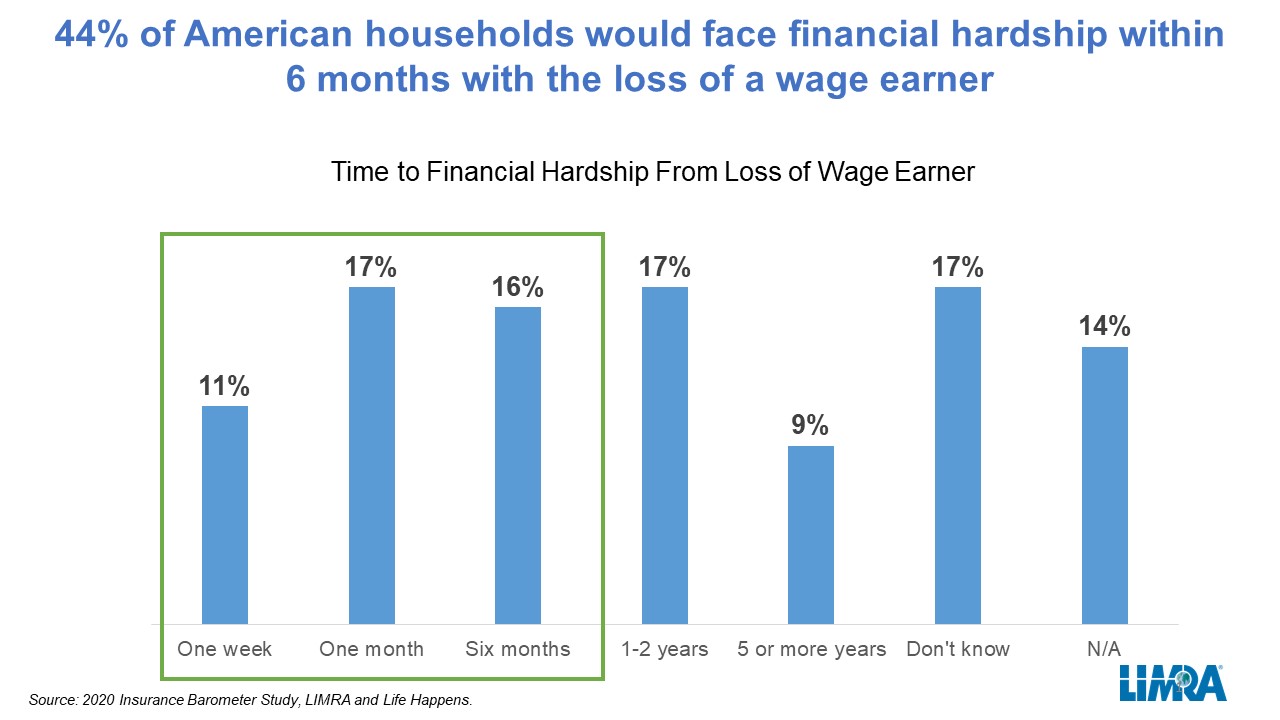

When LIMRA asked consumers how long it would be for their family to face financial hardship if the primary wage earner were to die prematurely, the results were sobering. Forty-four percent — almost half — of households said they would face financial hardship within six months. For 28%, it would be within just one month.

This underscores the importance of renewing our commitment to make progress in closing the life insurance coverage gap as we enter 2021. Our research shows that there are 30 million uninsured households in our country — families that need insurance, but don’t have it. Our research also shows there are another 30 million households that are underinsured, that have insurance, but not at the level to appropriately protect their families.

This week, LL Global, the parent organization of LIMRA and LOMA, partnered with six other associations — the American Council of Life Insurers, Life Happens, Finseca, NAIFA, NAILBA, and MDRT — to launch the Help Protect Our Families campaign, an effort to raise industry awareness about the life insurance coverage gap that exists in the U.S. and provide resources that will help our collective members get more Americans the financial protection they need.

Together, we believe we can help fulfill the industry’s noble purpose and provide Americans a level of financial peace of mind and stability at a time when so much else has been uncertain.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257