-

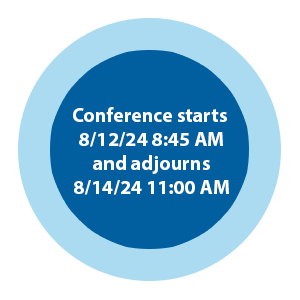

Monday, August 12, 2024

9:00 a.m. - 10:00 a.m.: GS1 — Best Planning Ideas for the Twilight of the Higher Exemptions

Kathleen Bilderback, JD, LL.M. (Taxation), AEP

Counsel, Sandberg Phoenix & von Gontard P.C.

Kathleen Bilderback specializes in estate, business, and executive benefits planning, with special emphasis on incorporating and maximizing the benefits of life insurance. She is a nationally recognized speaker, author, and former adjunct professor in the LL.M. in Taxation program at the Washington University School of Law in St. Louis.

Bilderback graduated from St. Louis University with degrees in Accounting and Theatre. She received her law degree and LL.M. in Taxation from Washington University’s School of Law. Beginning her Advanced Markets career at General American Life Insurance Company (later merged into MetLife), she provided training and advanced underwriting support for the top producers of MetLife and its subsidiaries for 10 years before returning to private practice. In 2007, Kathleen and her partners founded Affinity Law Group, LLC to provide legal services to businesses, their owners, and executives at every stage of their life cycles. She rose to the position of Managing Member prior to successfully combining the firm into Sandberg Phoenix, a firm of approximately 200 attorneys in eight offices with a nationwide practice.

She is a member of the Missouri, Illinois, and Pennsylvania bars. She is a former national President of the Society of Financial Service Professionals. She has been an active member of the National Association of Insurance and Financial Advisors (NAIFA) at the national and local level. She currently serves on the Board of Directors of the St. Louis Zoo Association and the St. Louis Children’s Hospital Foundation Planned Giving Committee. She received the Accredited Estate Planner designation from the National Association of Estate Planners & Councils. She has presented at AALU and the Top of the Table Meeting for the Million Dollar Roundtable. Kathleen was selected for inclusion in Missouri and Kansas SuperLawyers each year since 2012 and recognized by Best Lawyers in the areas of Business Organizations, Closely Held Companies and Family Businesses Law, and Trusts and Estates each year since 2020.

Created by advanced sales professionals, the Forum provides advice and insights from industry leaders, and subject matter experts, with unique expertise in this segment of the financial services market. Whether you are seeking new, innovative ways to meet the challenges of organizational change, creative, yet proven concepts to bring to your distribution partners, or finding more effective ways to communicate with and educate stakeholders, attending the Forum will give you unparalleled insights from peers and implementable ideas from experts.

Created by advanced sales professionals, the Forum provides advice and insights from industry leaders, and subject matter experts, with unique expertise in this segment of the financial services market. Whether you are seeking new, innovative ways to meet the challenges of organizational change, creative, yet proven concepts to bring to your distribution partners, or finding more effective ways to communicate with and educate stakeholders, attending the Forum will give you unparalleled insights from peers and implementable ideas from experts.