Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

3/3/2022

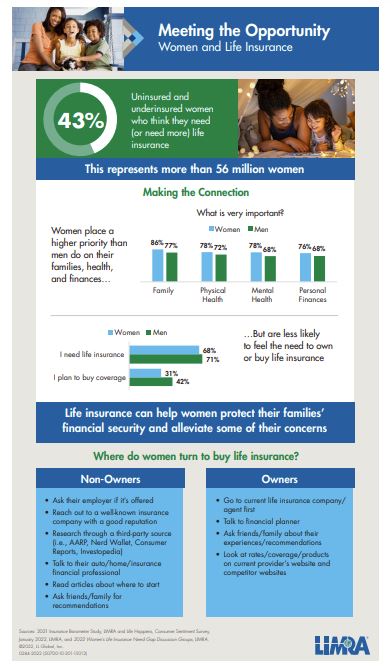

Over the past five years, the life insurance ownership rate for U.S. women has dropped 10 points to 47%. Throughout the pandemic, women expressed a higher concern about the financial, physical and mental impact of COVID-19 on them and their families. Yet these concerns didn’t necessarily prompt women to consider buying life insurance. Just 31% of women said they would likely purchase coverage in 2021, compared with 42% of men.

To get a better understanding about why some women were reluctant to purchase life insurance coverage and their perceptions about the process and the industry, LIMRA conducted a qualitative study in February 2022, speaking to women about their financial priorities, their perceived barriers to purchasing life insurance, and how the industry can adjust to better serve them.

The overwhelming reason women say they don’t buy life insurance is lack of knowledge — they don’t know how much or what to buy. According to the 2021 Insurance Barometer Study conducted by LIMRA and Life Happens, only 22% of women feel very knowledgeable about life insurance, compared with 39% of men. This lack of knowledge leads to misperceptions about life insurance. For example, a common reason women give for not purchasing life insurance is that they think it is too expensive. Yet, 8 in 10 women overestimate the cost of life insurance.

The overwhelming reason women say they don’t buy life insurance is lack of knowledge — they don’t know how much or what to buy. According to the 2021 Insurance Barometer Study conducted by LIMRA and Life Happens, only 22% of women feel very knowledgeable about life insurance, compared with 39% of men. This lack of knowledge leads to misperceptions about life insurance. For example, a common reason women give for not purchasing life insurance is that they think it is too expensive. Yet, 8 in 10 women overestimate the cost of life insurance.

Lack of knowledge also undermines women’s confidence in shopping for and purchasing coverage and leads to fear of being taken advantage of, creating a barrier to entry. In the focus groups, women said beyond learning about what to expect when purchasing coverage, they would like to see comparisons of options and pricing as well as getting a personalized coverage plan that addresses their short- and long-term needs.

Building trust is an important factor for women. Some women expressed anxiety about being treated differently by insurance companies and financial professionals. They say they are uncomfortable sharing personal information with an agent or company. Acknowledging women’s uncertainty, insurers and financial professionals can offer information and tools that enable women to compare their coverage choices with their peers, increase their self-confidence and remove some of their hesitancy to buy the life insurance they need.

Despite these obstacles, a significant portion of women recognize their need for life insurance, indicating a substantial opportunity for the industry. In the 2021 Insurance Barometer Study, 43% of women say they need (or need more) coverage, which represents 56 million women. As our nation celebrates Women’s History Month, it is also a good reminder about the industry’s responsibility to engage and educate women about life insurance so they are confident in choosing the right company, agent, policy, and coverage amount to help them protect their families’ financial futures.

LIMRA is honored to lead the Help Protect Our Families campaign, an industrywide effort to raise awareness about the importance of life insurance and help carriers and distributors address the growing coverage gap in the United States. Visit the Help Protect Our Families website for more resources and data on the U.S. women’s market.

To learn more about women’s perceptions and motivations for buying life insurance, read Understanding the U.S. Women’s Market fact sheet.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184