The Ups & Downs of Investor Annuity Choice

Most investors appreciate the combination of upside potential and downside protection offered by FIAs and RILAs.

Three products have dominated the U.S. individual deferred annuity industry for years: traditional variable (VA), fixed indexed (FIA), and fixed-rate deferred (FRD). Recently, a new product category — registered index-linked annuities (RILAs) — has gained popularity. Each product type provides a different value proposition, exposure to risk, and range of returns, and each appeals to a specific segment of investors.

In the current investment environment — where interest rates are low and stock market returns have generally been strong — annuity carriers and distributors need to understand which product concepts have the greatest appeal, and which investors favor certain products.

While past research has focused on the “core” value proposition of an annuity, i.e., the lifetime-guaranteed income option, less is known about how consumers value specific annuity product types (beyond what we can learn from actual sales patterns). A recent annuity study from LIMRA examined investor preferences for the four main types of deferred annuities now on the market. We asked investors to consider their current financial situation, and to select one of four investment options with varying degrees of downside protection and upside potential in which to “invest” $100,000 for five years. Rather than use the industry terms for the product types, we provided study participants with a basic description and hypothetical outcomes.

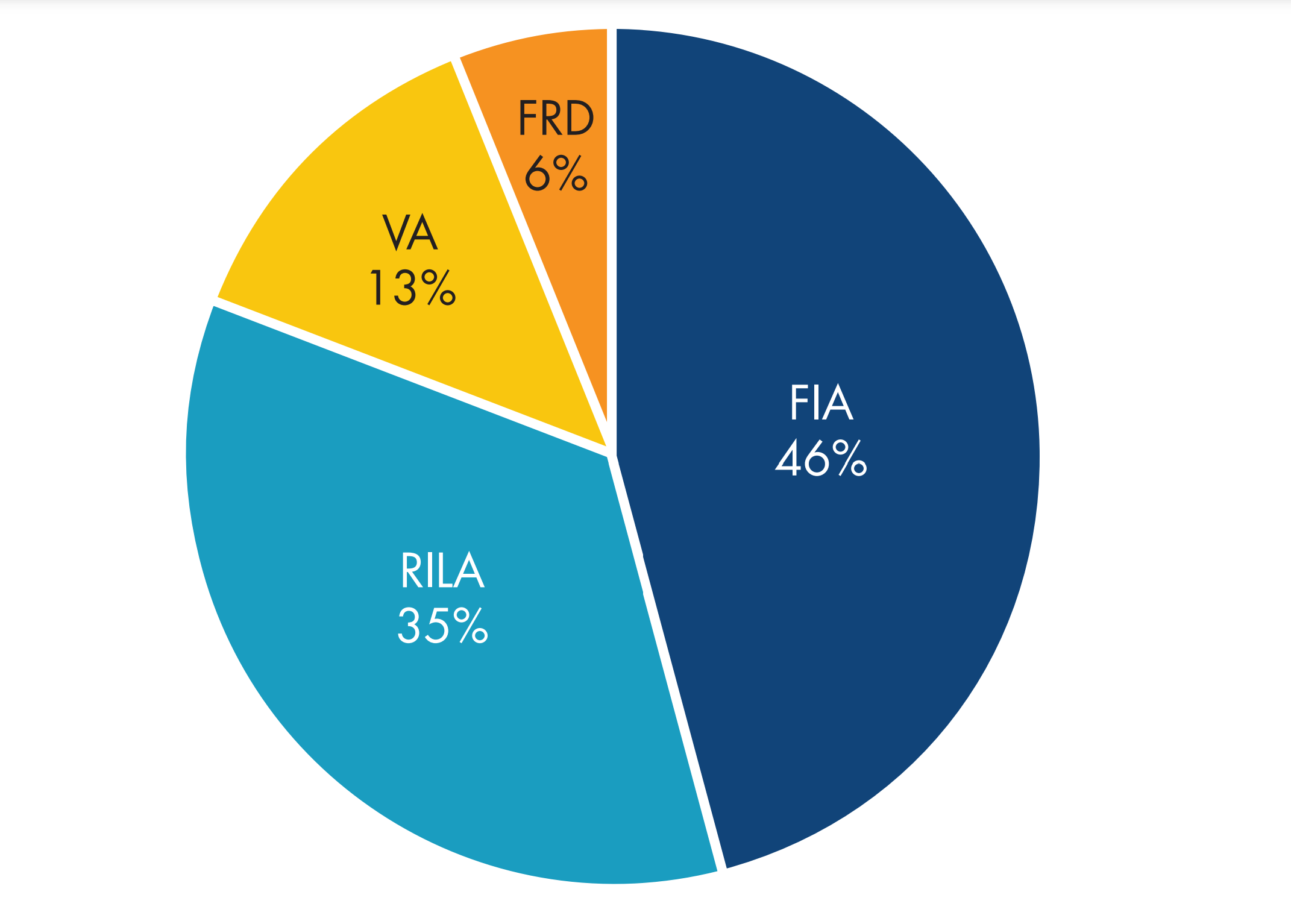

Nearly half of investors (46 percent) selected the “full downside protection, limited upside potential” option, which corresponds to an FIA (Figure 1). FIAs are especially popular among older, more conservative, and less financially knowledgeable investors. The top reason for this selection was their placing more value on protecting savings than seeking maximum gains.

Thirty-five percent of investors chose the “limited downside protection, limited upside potential” option, which corresponds to a RILA. Those who selected RILAs tend to believe the stock market will perform well over the next five years, and value the ability to maximize gains. At the same time, those selecting RILAs are also concerned about putting the money at risk, despite their optimistic outlook — otherwise they would have selected the VA option.

Note: Based on 2,034 investors who a) were aged 40 to 75, b) had household investable assets of $100,000 to $1.9 million, and c) were involved in household financial decision making.

Source: The Upside and the Downside: Annuity Product Selection, Secure Retirement Institute, 2022.

Unlimited upside potential with no downside protection — which corresponds to a traditional VA (with no fixed return fund or guaranteed living benefit) — was the third most commonly selected option, chosen by 13 percent of investors. As with those who selected RILAs, this group values the ability to maximize gains and is bullish on the stock market; unlike those who picked RILAs, they are willing to take on all of the downside risk to have a chance at unlimited gains. Investors who consider themselves very knowledgeable about investments are significantly more likely than other investors to pick the VA option. They also tend to be more confident in their investment decisions, have a higher investment risk tolerance, and want to make their own decisions rather than delegate them to an advisor.

Fixed-rate deferred annuities (full downside protection, no upside potential) are the least popular, chosen by only 6 percent of investors. FRDs represent the safest option, offering no losses or uncertainty about the final value after five years; accordingly, investors who chose FRDs cite safety as their main appeal. This group places more value on protecting savings than seeking maximum gains. Yet the current low-interest-rate environment works against FRDs when directly pitted against the other deferred annuity types with considerably higher upside potential.

This overall selection pattern reveals that most investors appreciate the combination of upside potential and downside protection offered by FIAs and RILAs. In the context of a multi-year bull stock market, the notion of protecting assets clearly has traction. But, with interest rates so low, many investors also want to avoid locking in a low rate of return. If the opposite conditions — a prolonged stock market downturn with higher interest rates — were to occur, it is likely that investors would seek more downside protection. Working with their distribution partners, carriers can win in either environment by connecting the specific objectives of their products with the needs and mindsets of investors.