Winning in the Retail Retirement Market Game

Winning in the Retail Retirement Market Game

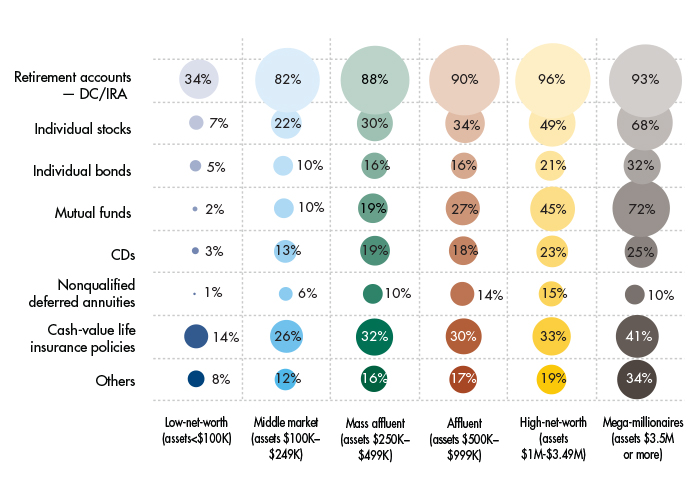

While ownership of most financial products increases with wealth levels, this should not discourage advisors and firms from reaching out to consumers across all segments. As the total wealth owned by each segment continues to grow, the opportunity within each increases.

Source: Secure Retirement Institute analysis of 2019 Survey of Consumer Finances, Federal Reserve Board, 2020. All investment types except 401(k)/IRA accounts are held in nonqualified portfolios.

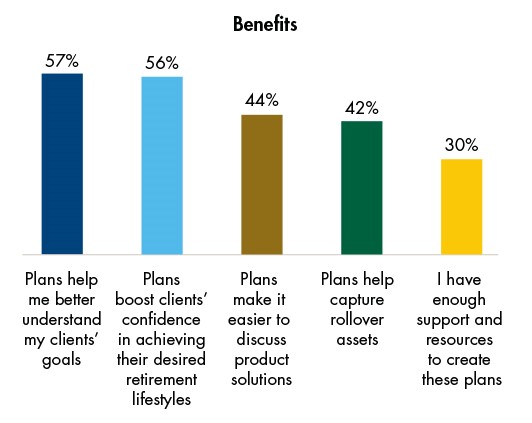

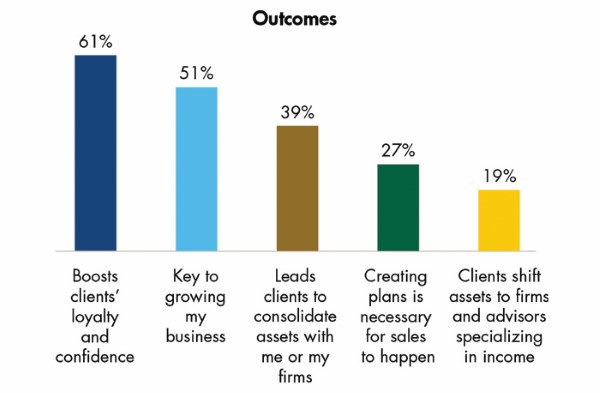

Diligent retirement planning and guidance from an experienced advisor can help clients to accomplish a financially secure and realistic retirement lifestyle. Advisors who utilize formal written plans (FWPs) can help guide investors through the accumulation phase and into decumulation. While FWPs can be time-consuming for advisors to create, Americans are willing to pay for comprehensive advice. FWPs result in better relationships, more business via rollovers and asset consolidation, and easier discussions about product solutions.

Source: 2021 Retail Advisor Survey. Secure Retirement Institute, 2021. Based on 517 financial advisors who offer FWPs to their clients.