Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

10/26/2021

WINDSOR, Conn., Oct. 26, 2021 — Opening the 2021 LIMRA Annual Conference, David Levenson, president and CEO of LIMRA, LOMA and LL Global, discussed the challenges the financial services industry was facing even before the pandemic and how ― through being adaptive and resilient ― the industry will move forward stronger.

WINDSOR, Conn., Oct. 26, 2021 — Opening the 2021 LIMRA Annual Conference, David Levenson, president and CEO of LIMRA, LOMA and LL Global, discussed the challenges the financial services industry was facing even before the pandemic and how ― through being adaptive and resilient ― the industry will move forward stronger.

Levenson referenced his remarks at the 2019 LIMRA Annual Conference in Boston when he talked about challenges the industry was facing, including existing legacy systems, declining bond yields, company consolidation, shrinking distribution, increasingly complex regulations, and so much more.

“And then COVID hit. While COVID has been a massive challenge for all of us on so many fronts, it was inspiring to see how well the life industry responded,” Levenson said.

At this year’s conference, Levenson talked about the new set of challenges brought on by a global pandemic. These included historically low interest rates, a need to pivot to accelerate adoption of new digital processes, and create a socially distant and/or remote work environment for home office and field personnel, while maintaining the productivity and culture of each company.

“Our member companies did a remarkable job developing and expanding their automated underwriting to allow for the fact that paramedical professionals were no longer able to visit prospective customers at their homes or places of work,” he said.

This has proved to be a positive experience for many companies and, according to LIMRA research, a large majority (8 in 10) plan to make these changes permanent.

This was important given the enhanced interest in life insurance as a result of COVID-19. According to the 2021 LIMRA Barometer study, conducted by LIMRA and Life Happens, 31% of consumers said they were more likely to buy life insurance in the next 12 months because of the pandemic.

These changes also affected sales. “While life and annuity sales were hit early in 2020, new life policy sales dropped by only 1% in the first quarter compared to the first quarter of 2019, and actually rose in the second, third, and fourth quarters. By second quarter 2021, annuity sales were $68.2 billion (up 40% from prior year) and the total number of life insurance policies sold increased 7%, compared with prior year results,“ Levenson noted.

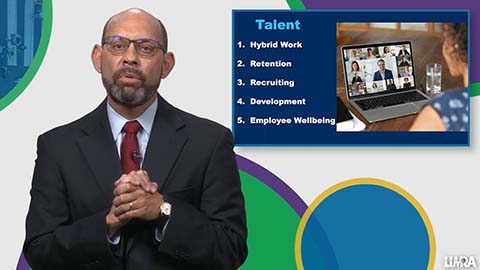

Today, among the challenges the industry is facing are record levels of mergers and acquisitions, new nontraditional entrants to the industry, and the need for companies to think about recruiting, retaining and developing company talent differently.

With all of this continued change, however, Levenson noted that one thing is clear. LIMRA and member companies will work together to “Shape a More Purposeful Future” ― the theme of this year’s conference ― for both customers and employees.

-end-

About LIMRA®

Serving the industry since 1916, LIMRA helps to advance the financial services industry by empowering nearly 700 financial services companies in 53 countries with knowledge, insights, connections, and solutions. Visit LIMRA at www.limra.com.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184