Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

12/14/2023

WINDSOR, Conn. Dec. 14, 2023 —Despite mixed results in the third quarter, new annualized premium for workplace life insurance, disability insurance and supplemental health products remain ahead of 2022’s pace through the first nine months of 2023, according to LIMRA’s workplace benefits sales surveys.

Life Insurance

Life Insurance

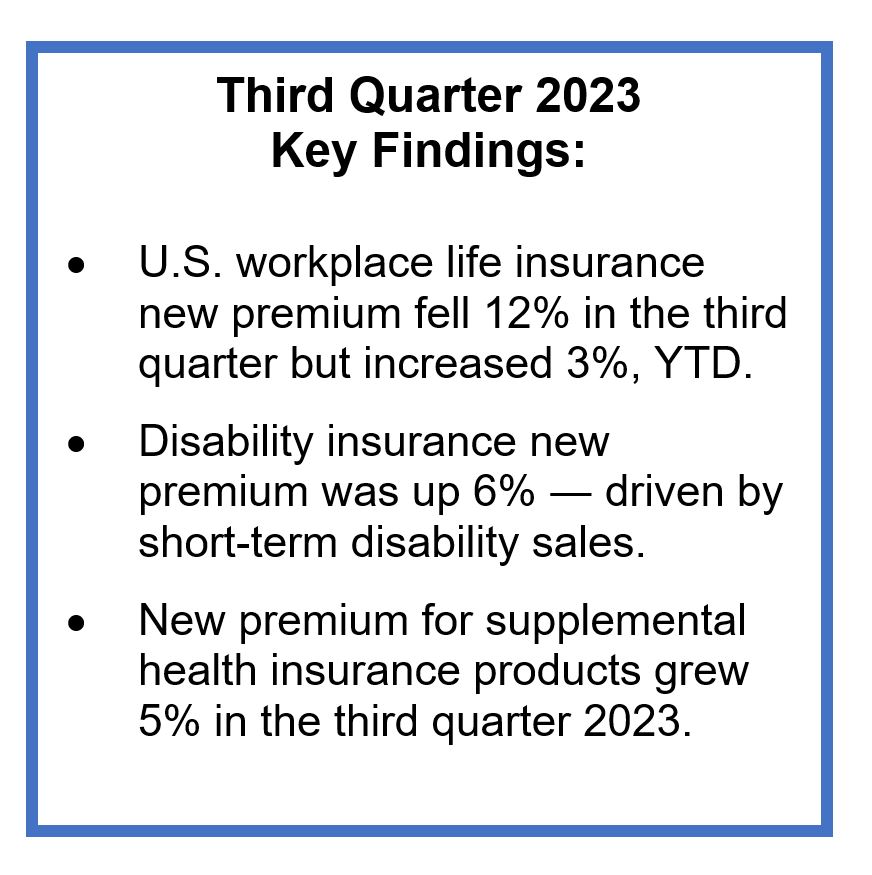

Third quarter 2023 workplace life insurance new premium was $588 million, down 12%, compared with third quarter 2022. However, year-to-date (YTD) new premium remained 3% ahead of the sales in the same period a year ago, totaling $3.2 billion.

“While sales are down for the third quarter, a strong first half of the year has helped keep year-to-date sales ahead of 2022 levels,” says Patrick Leary, corporate vice president and director of LIMRA’s workplace benefits research program.

Disability Insurance

Total workplace disability insurance new premium for the third quarter was $628 million, 6% higher than prior year results. In the first nine months of the year, new annualized premium totaled $3.1 billion, a year-over-year increase of 9%.

Short-term disability insurance premium, up 11%, drove overall growth in the quarter. YTD, short-term disability insurance premium jumped 19%. Long-term disability premium was flat for the quarter and down 2% YTD.

Supplemental Health Insurance

New annualized premium for supplemental health products ― accident, critical illness, cancer, hospital indemnity, and other supplemental health insurance products* ― totaled $501 million in the third quarter, up 5%. In the first three quarters of 2023, new premium for supplemental health products was nearly $2.3 billion, a 7% increase from the same period in 2022.

While accident insurance new premium was flat in the third quarter, other lines recorded growth, with critical illness new premium up 10%, cancer insurance new premium increasing 18%, and hospital indemnity insurance new premium rising 5%. YTD, all supplemental health lines showed new premium growth. Accounting for 90% of all workplace supplemental health sales, accident, critical illness, and hospital indemnity insurance showed new premium gains of 3%, 6%, and 9%, respectively.

“With the labor market remaining strong, employee benefits are an integral part of attracting and retaining talent in a competitive environment,” Leary said. “LIMRA research finds 51% of employers plan to expand their benefits offerings over the next five years, which will continue to drive the positive sales trends we have witnessed since 2021.”

LIMRA’s workplace benefits sales surveys for life insurance, disability insurance and supplemental health represent at least 90% of their respective annualized premium markets.

You can find the latest data table with U.S. workplace sales trends in LIMRA’s Fact Tank.

-end-

*“Other supplemental health products” represents products that do not fit the other categories, such as gap insurance, minimum essential coverage plans, limited benefit medical, and heart/stroke products.

About LIMRA

Serving the industry since 1916, LIMRA offers industry knowledge, insights, connections, and solutions to help more than 700 financial services member organizations navigate change with confidence. Visit LIMRA at www.limra.com.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184