Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

10/11/2023

New research shows the impact of formal plans on retirement preparedness is significant

One of the best actionable steps one can take toward a secure retirement is creating a formal written financial plan. Formal plans help keep consumers on track with their retirement goals and give them peace of mind.

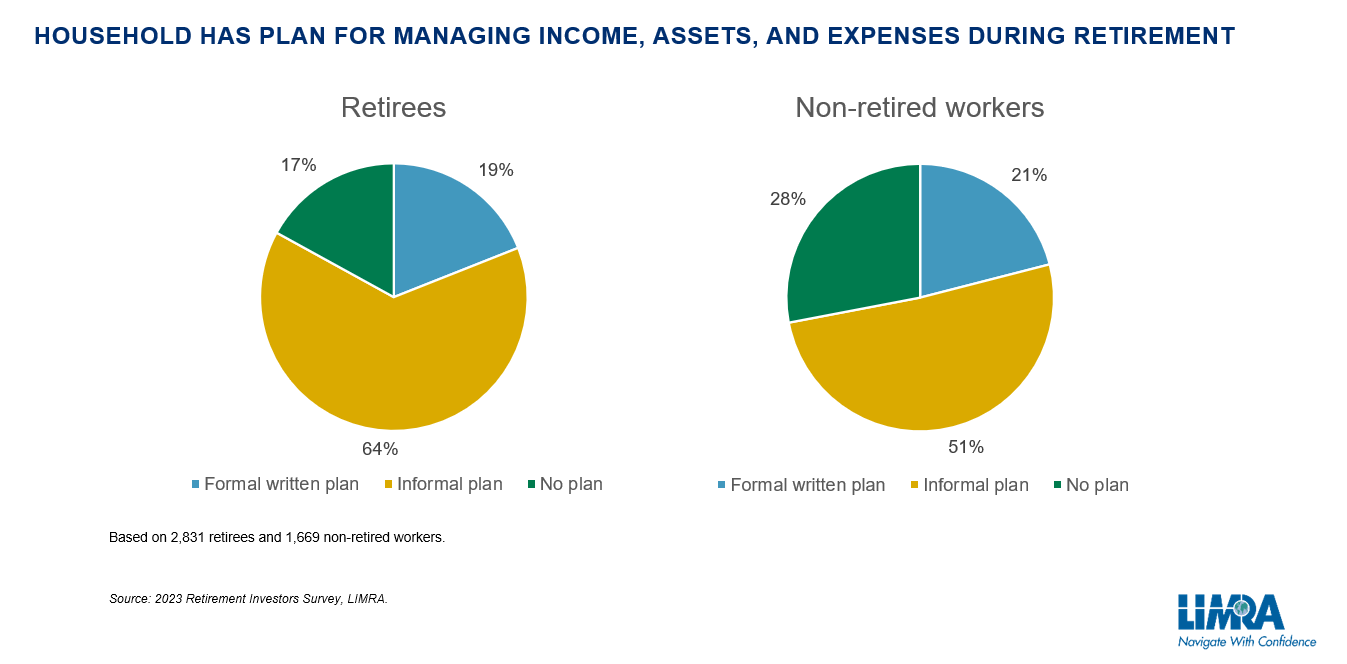

New LIMRA data on retirement investors (ages 40-85 with at least $100,000 in investible assets) shows that a financial retirement plan leads to greater retirement confidence. Eighty-seven percent of investors with a formal written retirement plan and 70% of investors with an informal retirement plan report feeling confident in their ability to live the retirement lifestyle they want. However, LIMRA finds that just 1 in 5 retirees and non-retired workers have developed a formal written retirement plan.

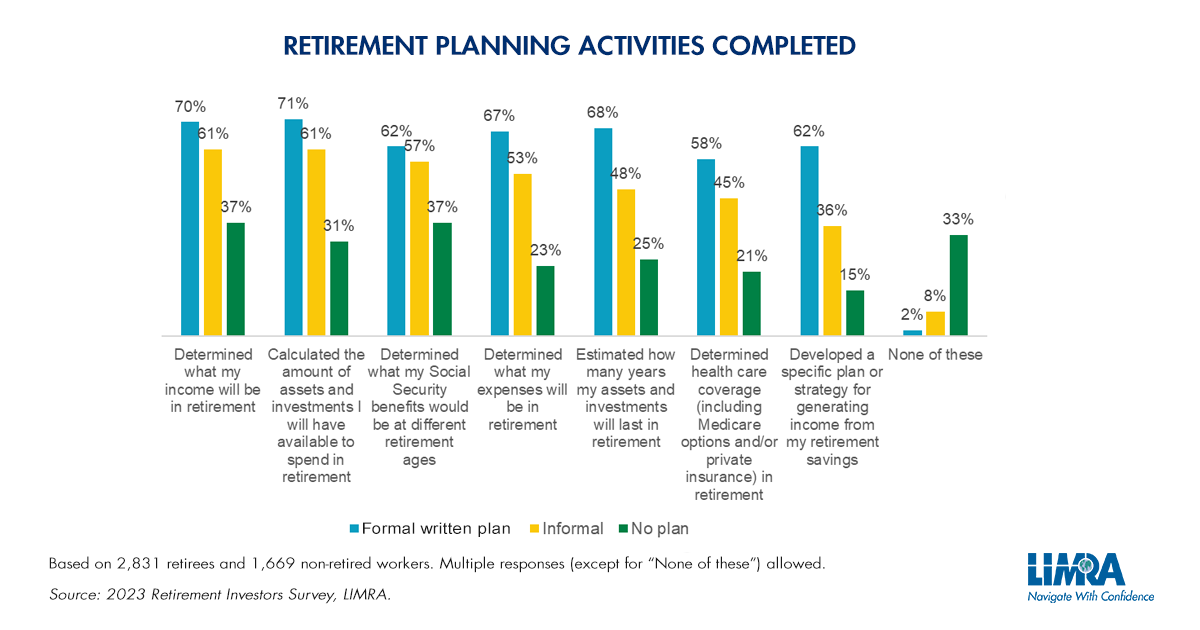

Additionally, formal retirement plans increase the probability of completing key retirement planning activities, such as determining one’s income in retirement, calculating the total assets and investments available, and estimating the years those assets and investments will last.

Public Policy and Inflation Are Among the Top Retirement Concerns

A formal retirement plan can help safeguard against retirement risks.

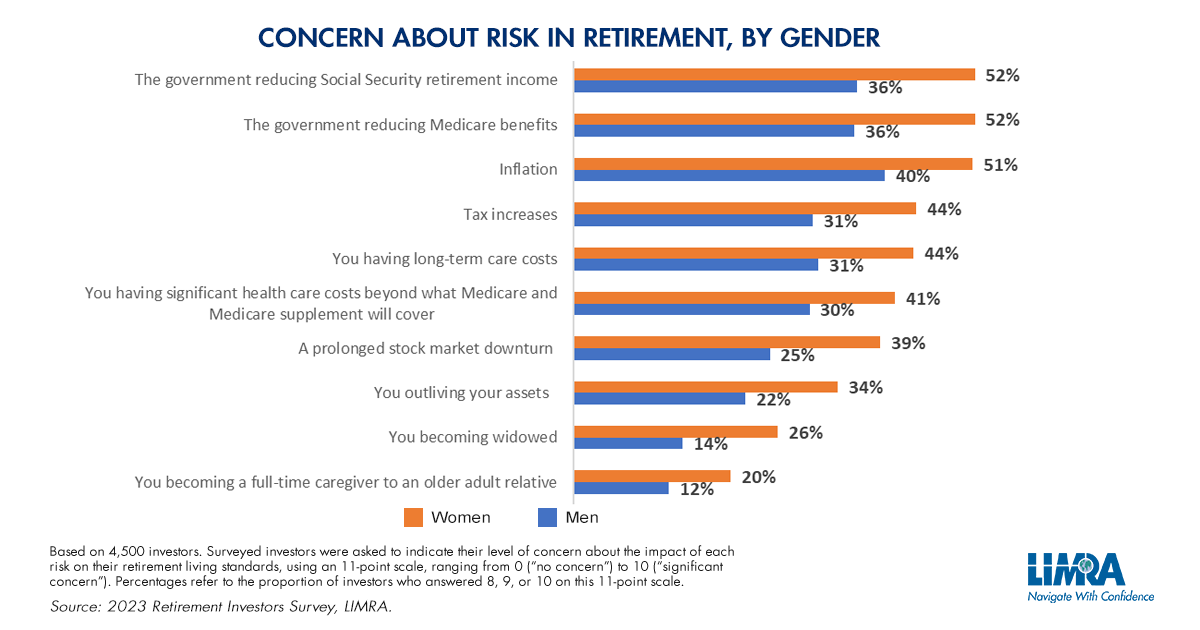

When asked about their retirement concerns, 4 in 10 retirees listed public policy around social security and Medicare benefits, while non-retired workers cited inflation risk (51%) and tax increases (43%). Investors who report having lower household investable assets, lower knowledge of financial products, or do not have a formal written plan are more likely to have these concerns. On average, female investors tend to have more retirement concerns than male investors.

Investors’ Interest in Annuities Has Increased

There’s also a positive relationship between formal retirement planning and owning annuity products. Thirty-six percent of investors who created a formal retirement plan own one or more annuities, compared with 27% of investors with informal plans and just 16% of investors without a formal retirement plan.

Of investors who own annuities and who have formal written plans, 70% purchased their annuities because of the plan. This could be in response to their heightened awareness of the need for guaranteed income. Through the planning process, investors are more likely to discover that they will need a way to systematically withdraw from their retirement accounts as they have a clearer picture of their retirement situation.

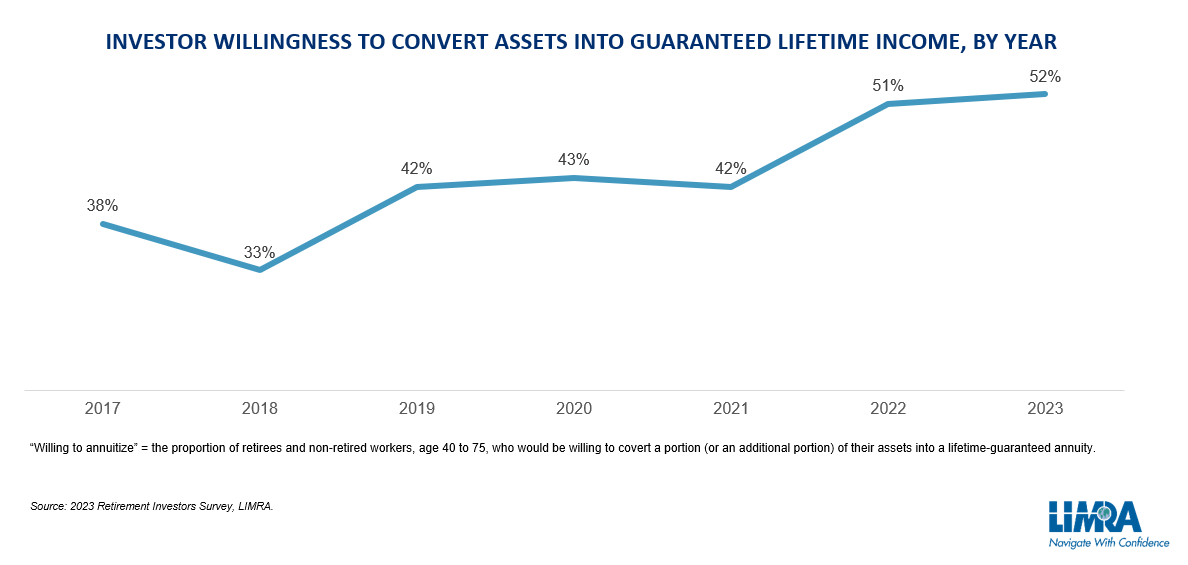

LIMRA data shows the proportion of workers who feel confident that their guaranteed income sources will cover their basic living expenses in retirement has fallen in four of the last six years, coinciding with an increase in investors' willingness to convert assets into lifetime-guaranteed income, which has increased 14 percentage points from 38% in 2017 to 52% in 2023.

A formal retirement plan can help identify their financial risks in retirement, determine their needs, and determine the best annuity product to address them.

Effective retirement planning can help investors — regardless of age — fully understand their retirement situation. This National Retirement Security Month, let’s continue to engage consumers about the importance of systematic saving and retirement planning.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184