Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

11/28/2023

New LIMRA research reveals challenges and opportunities for adding in-plan annuities in retirement plans

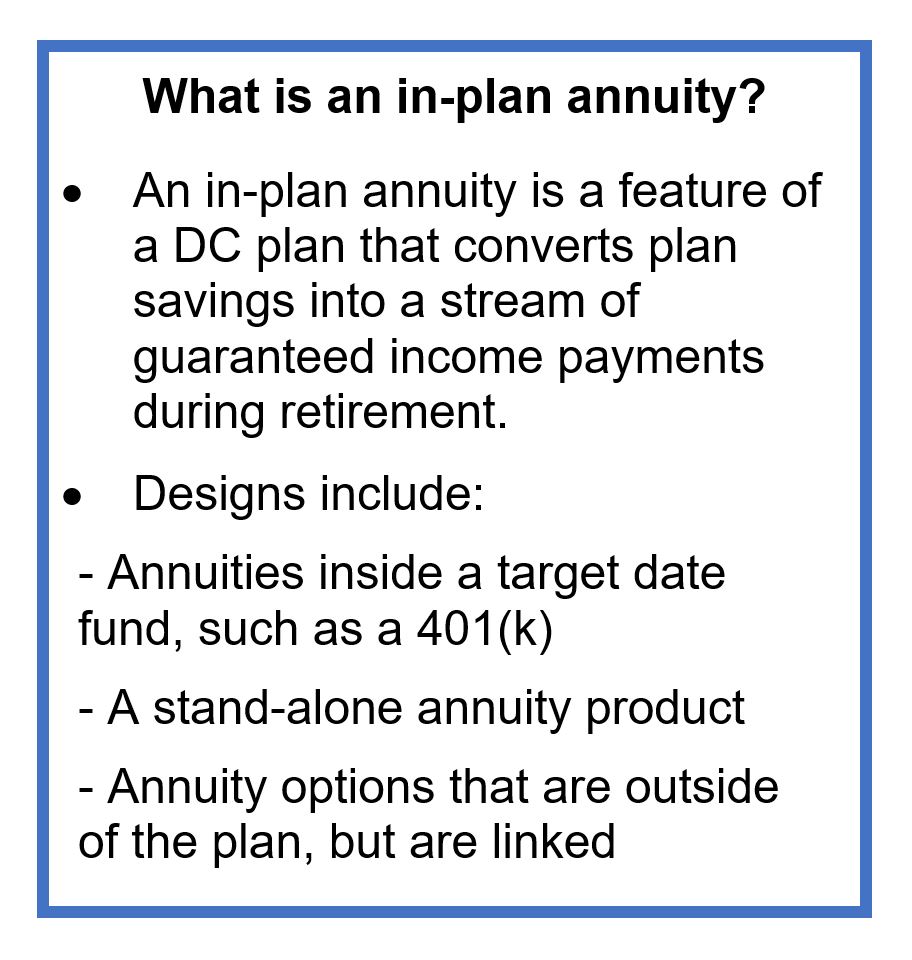

Today, the vast majority of defined contribution (DC) plans — an estimated 9 in 10 — have no in-plan option for generating lifetime-guaranteed income for retiring employees. Recent LIMRA research shows this trend may be changing.

Today, the vast majority of defined contribution (DC) plans — an estimated 9 in 10 — have no in-plan option for generating lifetime-guaranteed income for retiring employees. Recent LIMRA research shows this trend may be changing.

In a LIMRA survey of private-sector plan sponsors with at least 10 full-time employees almost half (49%) of those that do not offer an in-plan annuity in their DC plan say that they have considered adding one at some point. About 3 in 4 claim that they will make this decision within the next 12 months, underscoring the intense focus on these options over the past year.

While very large, established employers were among the first wave of plan sponsors to adopt in-plan annuities, the research suggests that there is growing interest at the smaller end of the market.

Today, in-plan annuity options are more likely to be offered:

There could be many reasons for an employer to decide to add an in-plan annuity to its DC plan. According to the research, the top four reasons are that they:

Overcoming Obstacles

In order for the in-plan annuity market to grow, the industry needs to overcome some perceived obstacles. For example, not every recordkeeper provides access to in-plan annuities on their platforms. Older, smaller employers are among the least likely to have access to, or have considered adding, in-plan annuities. As in-plan annuities rise in popularity, recordkeepers without any in-plan annuities on their platforms may be at a competitive disadvantage.

A top reason for not offering an in-plan annuity was prioritization — employers are placing more emphasis on other employee benefits. Although it might be expected that smaller employers who have limited staff and resources would more commonly mention this reason, it was the larger employers who most often cited it. Conceivably, these large companies may rotate through their review of benefit offerings on a systematic and scheduled basis.

Fewer than 1 in 5 plan sponsors mentioned fiduciary concerns as a potential barrier. SECURE 2.0 and other regulatory changes over the past few years likely have alleviated some of these concerns.

Other LIMRA research shows there has been an increase in workers’ willingness to convert assets into lifetime-guaranteed income, which has increased 14 percentage points from 38% in 2017 to 52% in 2023. These research findings and other evidence lead LIMRA to expect the in-plan annuity opportunity to grow exponentially over the next couple of years, enabling more workers to invest in guaranteed income within their DC retirement savings accounts.

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184