Media Contacts

Catherine Theroux

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Brooke Lacey

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184

2/18/2021

COVID-19 and social distancing measures upended many industries resulting in a record-high unemployment rate of 14.7% in April 2020. While the economy is slowly recovering, some market sectors continue to struggle. According to the Bureau of Labor Statistics, jobs in hospitality, transportation, health services and construction were among the greatest hit by the recession.

COVID-19 and social distancing measures upended many industries resulting in a record-high unemployment rate of 14.7% in April 2020. While the economy is slowly recovering, some market sectors continue to struggle. According to the Bureau of Labor Statistics, jobs in hospitality, transportation, health services and construction were among the greatest hit by the recession.

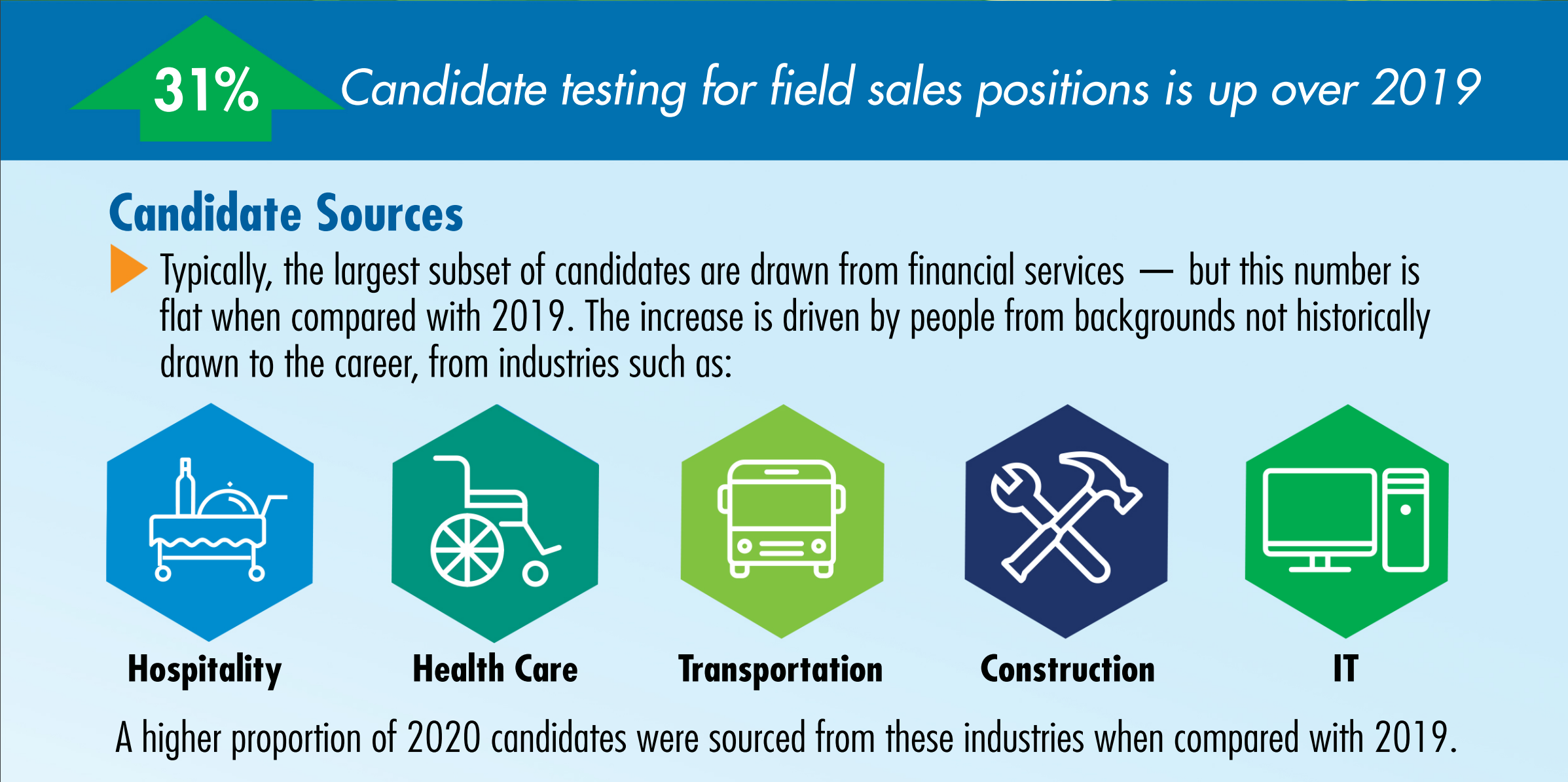

New LIMRA research suggests individuals who may have been affected by the pandemic-induced recession have turned to the life insurance industry for employment. According to LIMRA research, candidate testing for field sales positions in 2020 increased 31%, driven by candidates from hospitality, healthcare, transportation, construction and IT.

“Typically, the largest subset of new field sales candidates are drawn from financial services,” said Margaret McManus, Ph.D., assistant vice president, research and predictive analytics, Talent Solutions, LIMRA and LOMA. “In comparison to other industries, the life insurance market remains relatively stable. This may have attracted many people looking to find a new career.”

While an expanded candidate pool is always welcome, this doesn’t always translate into more agents. In fact, there was an 18% drop in the number of recruits and were contracted in the first half of 2020, compared with prior year.

“Life insurance is a multi-faceted and complicated industry. Effective salespeople have to be knowledgeable about a vast array of products and how they fit into a client’s financial plan,” said McManus. “These non-traditional candidates may need more information about the industry, its culture, and practices.”

The study finds that candidates with non-traditional backgrounds are less familiar with the industry. Thirty-three percent say they know ‘nothing or very little’ about a financial services sales career, compared to just 17% of candidates with traditional financial backgrounds. Nearly half (46%) of non-traditional candidates are concerned about being able to answer in-depth questions from prospects and clients and 3 in 10 say they worry about being accepted as a trusted financial advisor.

“Historically, when the unemployment rate increases, we see a rise in candidate testing,” noted McManus. “Recruiters who want to take advantage of the current environment should be prepared to address non-traditional candidates’ concerns as they proceed through the selection process and have a robust training and onboarding program in place to help these candidates better acclimate to a financial services career.”

There are 60 million uninsured and underinsured households in the United States. If the influx of interested candidates results in more agents available to serve these families and get them life insurance coverage to adequately protect their loved ones, it is a win for all. #HelpProtectOurFamilies

Director, Public Relations

Work Phone: (860) 285-7787

Mobile Phone: (703) 447-3257

Senior Public Relations Specialist

Work Phone: (860) 298-3920

Mobile Phone: (413) 530-6184